The regulator had included them as defendants in securities violation case, and the agency now says it’s just pursuing Ripple for damages.

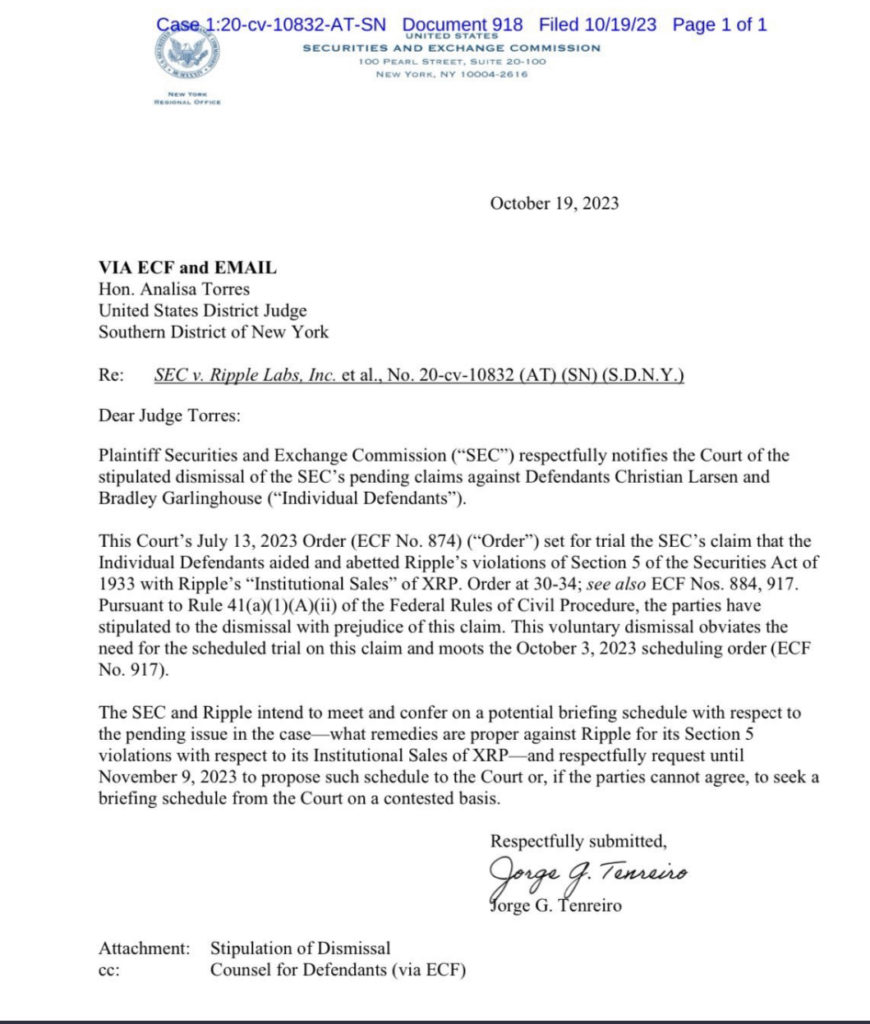

In a significant development regarding the ongoing case against Ripple and its CEOs, the Plaintiff Securities and Exchange Commission (SEC) has informed the honorable Judge Torres of the stipulated dismissal of its pending claims against Defendants Christian Larsen and Bradley Garlinghouse. The move comes following the Court’s order setting the trial for the SEC’s claim that the Individual Defendants aided and abetted Ripple’s violations of Section 5 of the Securities Act of 1933 through its “Institutional Sales” of XRP.

By invoking Rule 41(a)(1)(A)(ii) of the Federal Rules of Civil Procedure, both parties have agreed to the dismissal with prejudice of this particular claim. This voluntary dismissal not only eliminates the need for the scheduled trial but also renders moot the previously set October 3, 2023 scheduling order.

SEC Announces Dismissal of Claims Against Ripple and CEO’s, Shifts Focus to Remedies

Looking ahead, the SEC and Ripple have expressed their intention to engage in discussions and establish a potential briefing schedule regarding the issue at hand: determining the appropriate remedies against Ripple for its Section 5 violations in relation to its Institutional Sales of XRP. With this in mind, they respectfully request until November 9, 2023, to propose such a schedule to the Court. In the event that the parties cannot reach an agreement, they seek the Court’s intervention to set a contested basis for a briefing schedule.

This latest development marks a significant turning point in the case, with the focus now shifting towards the potential remedies that Ripple may face. As the SEC and Ripple prepare for further discussions, the outcome of these proceedings will undoubtedly shape the future of the cryptocurrency industry and its compliance with securities regulations.