By Francisco Rodrigues (All times ET unless indicated otherwise)

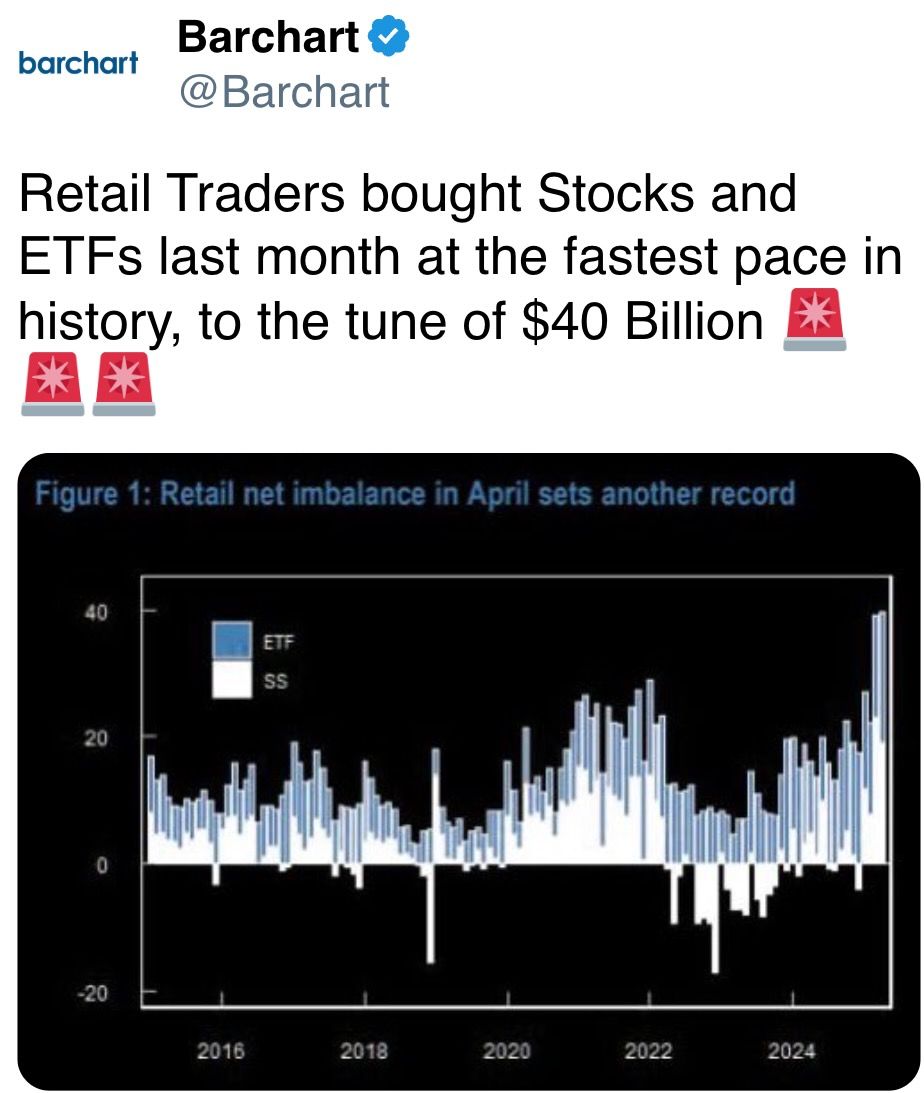

Markets seem bullish ahead of the jobs report due later Friday, with bitcoin (BTC) rising toward $97,000 after stocks rose for an eighth straight day on Thursday. That gave the S&P 500 its longest rally since August as investors grew more confident that trade tensions between Washington and Beijing are cooling.

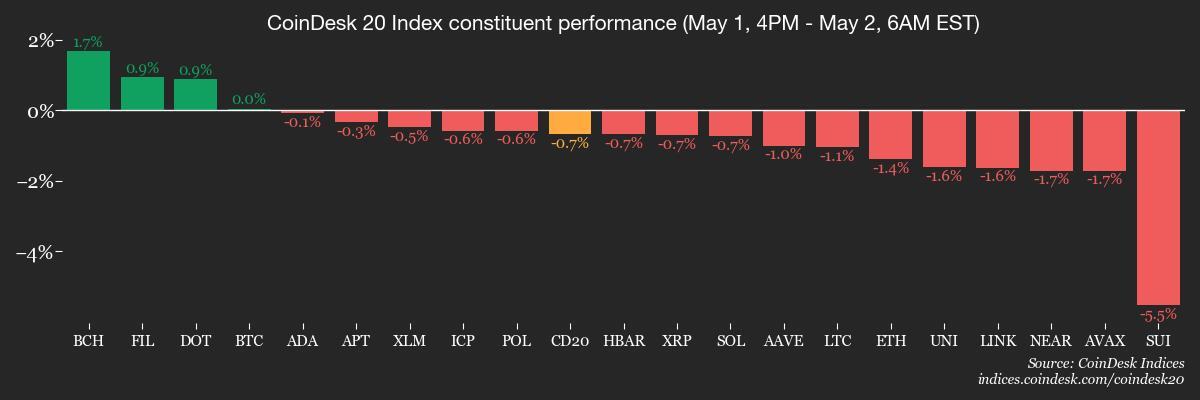

Still, the CoinDesk 20 (CD20) index is little changed over the last 24 hours with the drop in first-quarter GDP pointing to economic strain from the trade war. While traders are now betting the Federal Reserve could cut interest-rates four times this year — one more than they’d priced in before the reciprocal tariffs were announced — personal consumption expenditures (PCE), the Fed’s preferred measure of inflation came in above forecasts, which limits the central bank’s room for easing, said James Butterfill, the head of research at CoinShares.

Today’s payrolls data remains a “critical piece of the puzzle,” he said.

“When the Fed eventually decides to cut rates, it is likely to do so in a knee-jerk and forceful manner — reacting to a significant deterioration in economic conditions rather than being proactive. Such a dramatic policy shift could act as a catalyst for a significant breakout rally in bitcoin, as investors seek alternative stores of value amid aggressive monetary easing,” Butterfill said.

That policy shift could align with bitcoin’s historical performance. Since 2013, the cryptocurrency has seen an average gain of 7.52% in May, according to CoinGlass data. And it’s not alone: ether (ETH), which has been significantly underperforming BTC, has posted an average gain of 27.3% in May since 2016, the best-performing month for the Ethereum blockchain’s token.

“Investor confidence is gradually returning to crypto markets following a volatile start to the year, with April seeing a rebound across majors as tariff-driven macro fears eased,” said Vijay Chetty, CEO of Eclipse. Growing regulatory clarity is an “underappreciated catalyst that will set the stage for broader institutional use cases,” Chetty added. Stay alert!

What to Watch

- Crypto:

- May 5, 3 a.m.: IOTA’s Rebased network upgrade starts. Rebased moves IOTA to a new network, boosting capacity to as many as 50,000 transactions per second, offering staking rewards of 10%-15% a year and adding support for MoveVM smart contracts.

- May 5, 11 a.m.: The Crescendo network upgrade goes live on the Kaspa (KAS) mainnet. This upgrade boosts the network’s performance by increasing the block production rate to 10 blocks per second from 1 block per second.

- May 6: Casper Network (CSPR) launches its 2.0 mainnet upgrade, introducing faster transactions, enhanced smart contracts, and improved staking features to boost enterprise adoption.

- May 7, 6:05 a.m.: The Pectra hard fork network upgrade will get activated on the Ethereum (ETH) mainnet at epoch 364032. Pectra combines two major components: the Prague execution layer hard fork and the Electra consensus layer upgrade.

- Macro

- May 2, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases April employment data.

- Nonfarm Payrolls Est. 130K vs. Prev. 228K

- Unemployment Rate Est. 4.2% vs. Prev. 4.2%

- May 2, 9 a.m.: S&P Global releases Brazil April purchasing managers’ index (PMI) data.

- Manufacturing PMI Prev. 51.8

- May 2, 11 a.m.: S&P Global releases Mexico April purchasing managers’ index (PMI) data.

- Manufacturing PMI Prev. 46.5

- May 5, 9:45 a.m.: S&P Global releases (Final) U.S. April purchasing managers’ index (PMI) data.

- Composite PMI Est. 51.2 vs. Prev. 53.5

- Services PMI Est. 51.4 vs. Prev. 54.4

- May 5, 10:00 a.m.: Institute for Supply Management (ISM) releases U.S. April economic activity data.

- Services PMI Est. 50.6 vs. Prev. 50.8

- May 2, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases April employment data.

- Earnings (Estimates based on FactSet data)

Token Events

- Governance votes & calls

- Compound DAO is voting on moving 35,200 COMP (~$1.5 m) into a multisig safe to test selling covered calls on COMP for USDC, lend that USDC in Compound for extra yield, then use the returns to buy back COMP and repeat—targeting roughly 15 % annual gain. Voting ends May 2.

- May 5, 4 p.m.: Livepeer (LPT) to host a Treasury Talk session on Discord.

- Unlocks

- May 2: Ethena (ENA) to unlock 3.10% of its circulating supply worth $53.44 million.

- May 7: Kaspa (KAS) to unlock 0.56% of its circulating supply worth $13.84 million.

- May 9: Movement (MOVA) to unlock 2.04% of its circulating supply worth $9.85 million.

- May 11: Solayer (LAYER) to unlock 12.87% of its circulating supply worth $79.71 million.

- May 12: Aptos (APT) to unlock 1.82% of its circulating supply worth $62.09 million.

- Token Launches

- May 2: Binance to delist Alpaca Finance (ALPACA), PlayDapp (PDA), Viberate (VIB), and Wing Finance (WING).

- May 5: Sonic (S) to be listed on Kraken.

Conferences

CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- May 6-7: Financial Times Digital Assets Summit (London)

- May 11-17: Canada Crypto Week (Toronto)

- May 12-13: Dubai FinTech Summit

- May 12-13: Filecoin (FIL) Developer Summit (Toronto)

- May 12-13: Latest in DeFi Research (TLDR) Conference (New York)

- May 12-14: ACI’s 9th Annual Legal, Regulatory, and Compliance Forum on Fintech & Emerging Payment Systems (New York)

- May 13: Blockchain Futurist Conference (Toronto)

- May 13: ETHWomen (Toronto)

- May 14-16: CoinDesk’s Consensus 2025 (Toronto)

Token Talk

By Shaurya Malwa

- Memecoin discussions are rising, while interest in layer-1 and layer-2 tokens is declining, signaling a shift toward speculative trading behavior, according to a Santiment report on Thursday.

- Retail investors are embracing hype-driven buying, favoring short-term gains over fundamentals.

- Market timing may be off, as historically the best altcoin entry points occur when crowd sentiment is low — not when terms like “altseason” and “bull cycle” are trending, the report said.

- Mentions of “buying crypto” have spiked, especially on dips, suggesting widespread eagerness and potentially premature confidence.

- Overconfident markets often face sharp corrections, especially when traders expect nonstop gains.

- As May begins, it remains to be seen if this altcoin surge is sustainable or simply another hype-driven blip.

Derivatives Positioning

- BTC’s current ascent appears structurally fragile, with a -$30 million liquidity delta across the 1% order book despite a 2.7% price rise since the start of the month, CoinGlass data show.

- This reduction in top-of-book liquidity as the price climbs leaves a thinner order book with an increasing the risk of slippage and volatility if momentum stalls.

- Liquidation heatmaps reveal sizable clusters at $97.6K ($67 million) and $96.1K ($58 million), reinforcing these zones as potential inflection points for intraday, volatility-driven reversals or stop-driven extensions.

- Binance funding rates show a sharp divergence in sentiment across major tokens, with APT, TON, UNI and XRP hitting +10.95% APR, while USDE (-29.73%), BNB (-19.06%), and SUI (-10.26%) reflect more intensive short-side pressure, Velo data shows.

- The concentration of elevated funding among large caps indicates directional long bias, while deeply negative rates in select altcoins suggest either event-driven shorts or systematic derisking.

- Open-interest (OI) rotation is flowing into low-cap, niche assets; with PUNDIX (+191%) and HAEDAL (+157%) leading 24-hour OI gains, according to Velo data. As open interest broadens out, market sensitivity to catalysts may increase across low to mid-cap tokens.

Market Movements

- BTC is up 2.27% from 4 p.m. ET Thursday at $96,817.27 (24hrs: +0.54%)

- ETH is up 1.48% at $1,822.64 (24hrs: -0.82%)

- CoinDesk 20 is up 1.39% at 2,781.37 (24hrs: -0.32%)

- Ether CESR Composite Staking Rate is down 9 bps at 2.958%

- BTC funding rate is at -0.0093% (-10.2251% annualized) on Binance

- DXY is down 0.51% at 99.74

- Gold is up 0.62% at $3,258.47/oz

- Silver is unchanged at $32.38/oz

- Nikkei 225 closed +1.04% at 36,830.69

- Hang Seng closed +1.74% at 22,504.68

- FTSE is up 0.75% at 8,560.68

- Euro Stoxx 50 is up 1.48% at 5,236.81

- DJIA closed on Thursday +0.21% at 40,752.96

- S&P 500 closed +0.63% at 5,604.14

- Nasdaq closed +1.52% at 17,710.74

- S&P/TSX Composite Index closed -0.19% at 24,795.55

- S&P 40 Latin America closed -0.25% at 2,523.42

- U.S. 10-year Treasury rate is up 8 bps at 4.23%

- E-mini S&P 500 futures are up 0.47% at 5,649.50

- E-mini Nasdaq-100 futures are up 0.33% at 19,935.75

- E-mini Dow Jones Industrial Average Index futures are up 0.47% at 41,045.00

Bitcoin Stats

- BTC Dominance: 64.85 (+0.16%)

- Ethereum to bitcoin ratio: 0.1886 (-1.0%)

- Hashrate (seven-day moving average): 847 EH/s

- Hashprice (spot): $49.98

- Total Fees: 5.51 BTC / $533,450.65

- CME Futures Open Interest: 141,430 BTC

- BTC priced in gold: 29.8 oz

- BTC vs gold market cap: 8.46%

Technical Analysis

- Ether has reclaimed its previous swing low, with the $1,750 level now acting as a key support zone.

- On the daily timeframe, price action is compressing between the 20- and 50-day exponential moving averages — a setup that often precedes a directional breakout.

- Assuming bitcoin remains in consolidation near its current resistance, ether has room to push higher, potentially retesting the prior range low around $2,100, which aligns with the 100-day EMA, adding further evidence for this as a target.

Crypto Equities

- Strategy (MSTR): closed on Thursday at $381.6 (+0.39%), up 1.37% at $386.82 in pre-market

- Coinbase Global (COIN): closed at $201.3 (-0.78%), up 0.56% at $202.42

- Galaxy Digital Holdings (GLXY): closed at $24.05 (+9.72%)

- MARA Holdings (MARA): closed at $14.05 (+5.09%), down 0.14% at $14.03

- Riot Platforms (RIOT): closed at $7.77 (+7.32%), down 1.93% at $7.62

- Core Scientific (CORZ): closed at $8.55 (+5.56%), up 0.58% at $8.60

- CleanSpark (CLSK): closed at $8.67 (+6.12%), up 0.69% at $8.73

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $14.59 (+6.65%)

- Semler Scientific (SMLR): closed at $33.33 (+3.09%)

- Exodus Movement (EXOD): closed at $40.38 (+3.43%), up 4.95% at $42.38

ETF Flows

Spot BTC ETFs:

- Daily net flow: $422.5 million

- Cumulative net flows: $39.53 billion

- Total BTC holdings ~ 1.15 million

Spot ETH ETFs

- Daily net flows: $6.5 million

- Cumulative net flows: $2.51 billion

- Total ETH holdings ~ 3.45 million

Source: Farside Investors

Overnight Flows

Chart of the Day

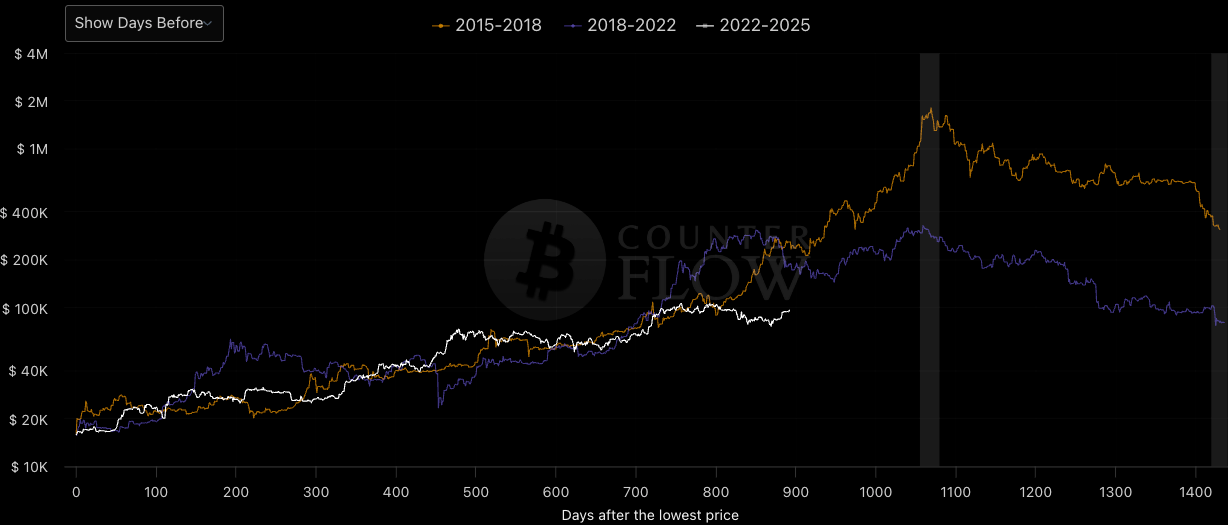

- Data from BitcoinCounterFlow comparing BTC’s performance from the bottom of each of the last three cycles suggests the top isn’t in yet.

- If history is any guide, the current trajectory around day 700–800 implies we’re entering a phase that could develop into the steep rally seen in prior cycles.

- The smoother rise this time may be a reflection of the increased institutional participation in the cryptocurrency ecosystem.

While You Were Sleeping

- Movement Labs Suspends Rushi Manche Amid Coinbase Delisting, Token-Dumping Scandal (CoinDesk): Co-founder Manche was suspended after Coinbase delisted MOVE following reports that a market maker tied to Web3Port dumped over 5% of the token’s supply, triggering a crash.

- China Is Considering Trade Talks With U.S., but It Has Conditions (The New York Times): China’s Commerce Ministry said it won’t enter trade talks unless U.S. tariffs are dropped, calling their removal the only way to demonstrate sincerity and rebuild trust.

- Metaplanet Issues $25M Bonds to Buy More Bitcoin (CoinDesk): EVO FUND purchased 3.6 billion yen ($24.8 million) of zero-coupon debt from Metaplanet, which intends to buy more bitcoin after recently exceeding 5,000 BTC.

- UK’s FCA Seeks Public and Industry Views on Crypto Regulation (CoinDesk): The Financial Conduct Authority is seeking feedback on staking, lending, intermediaries and decentralized finance.

- How China Is Quietly Diversifying From US Treasuries (Financial Times): China is reallocating reserves into gold, mortgage-backed securities and assets managed in places like Hong Kong, reducing reliance on dollar-denominated assets that could be sanctioned or frozen.

- Eurozone Inflation Holds Above Target as ECB Weighs Cuts (Bloomberg): Eurozone inflation held steady at 2.2% in April, defying expectations of a slowdown, while core inflation jumped to 2.7%.

In the Ether