By Francisco Rodrigues (All times ET unless indicated otherwise)

One of the biggest bitcoin BTC options expiries of the year has come and gone, and the largest cryptocurrency has declined just 0.6% in the past 24 hours to a little under $107,000.

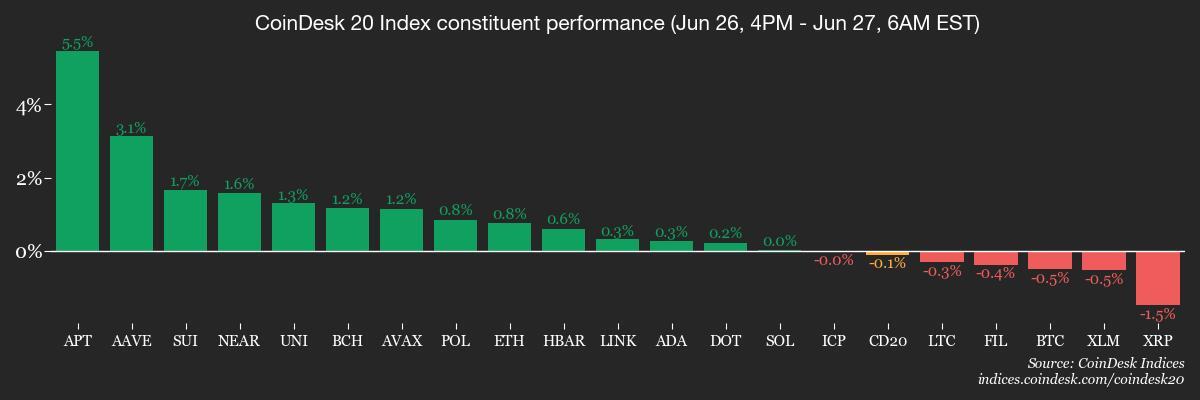

In bitcoin terms, that’s pretty much rock steady. For a look at how unperturbed traders are at the moment, consider Deribit’s BTC Volatility Index (DVOL), a measure of implied volatility. That’s now dropped to 37, its lowest level since late 2023. The broader crypto market is less sanguine, with the CoinDesk 20 (CD20) index down 1.2%.

Bitcoin’s reduced volatility is “perhaps a sign that the market is increasingly confident in its macro-hedge role,” Deribit’s Chief Commercial Officer Jean-David Péquignot told CoinDesk. “Bitcoin’s $105K level is pivotal, with technicals suggesting caution if support fails.”

The cease-fire in the Israel-Iran war has, no doubt, calmed geopolitical tensions for the time being, though that’s far from the only conflict in the world. Investors may also be waiting for directional signs from the economy, with U.S. personal consumption expenditures (PCE) due later today. That’s a report the Federal Reserve keeps a close eye on.

“Emergence of an external catalyst such as an escalation of the NATO-Russia tensions will test the market’s resilience, although the general mid-term upward price trajectory seems to remain in play,” Péquignot said.

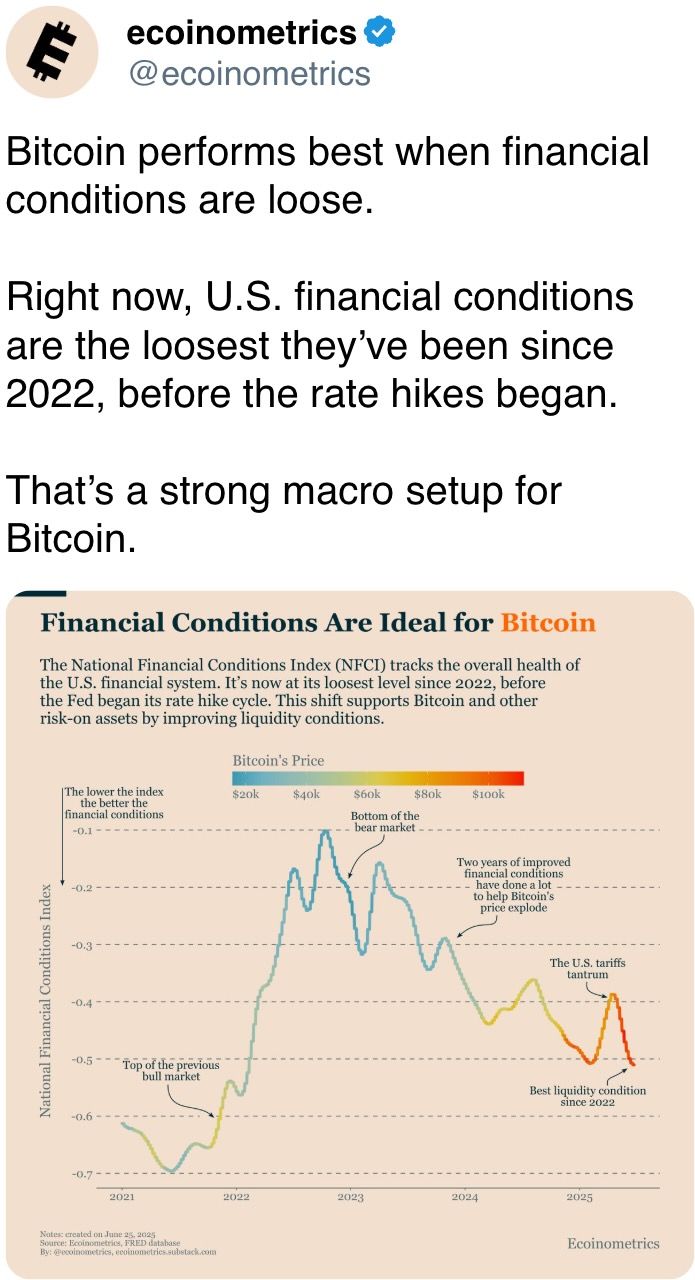

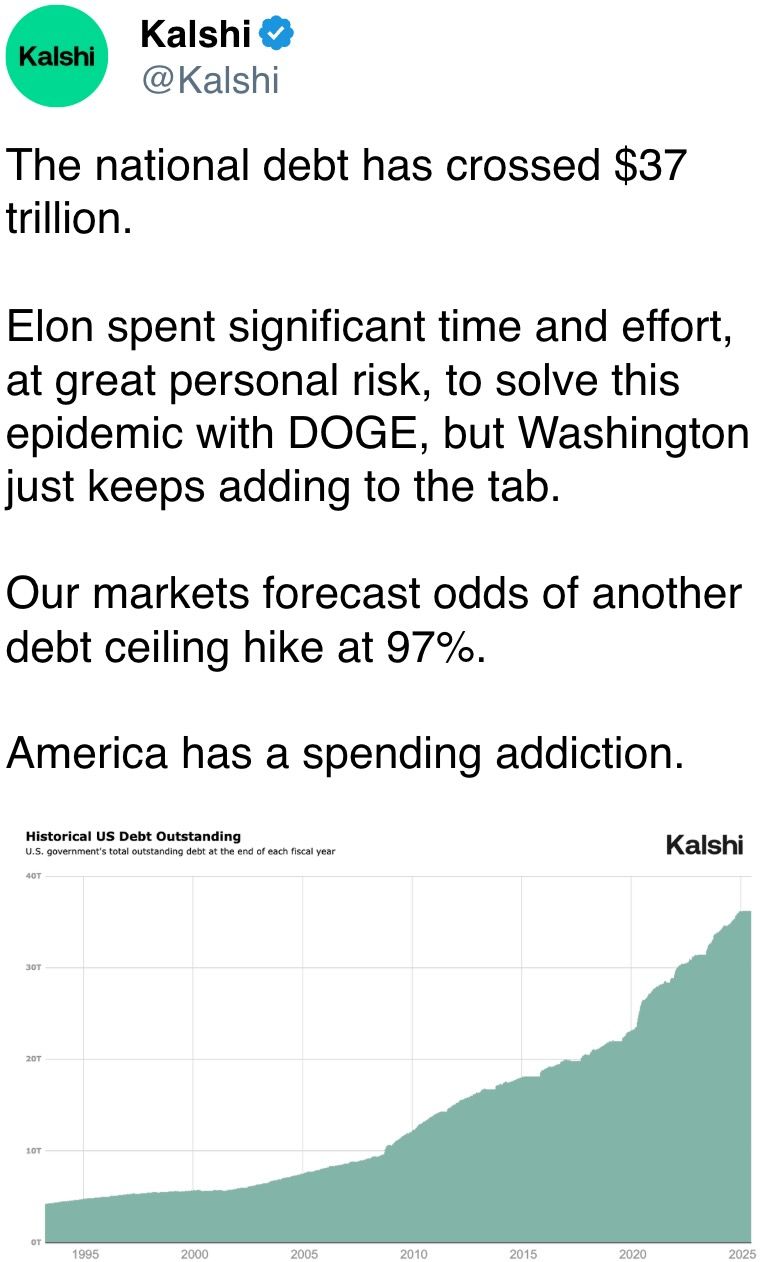

Reports that the White House may announce a successor to Fed Chair Jerome Powell in coming months raised fresh questions about the U.S. central bank’s independence, bringing down the greenback: The U.S. dollar index stumbled to a 3-year low.

Equity markets, meantime, have roared back to life. In Asia, shares hit a three-year high on optimism the U.S. and China have reached an agreement over the rare-earth trade, feeding a broader risk-on trend.

Still, the impending U.S. PCE report is dominating today’s agenda. A figure above economists’ estimates could hurt the chances of a July rate cut and undermine the current trend.

“The crypto market is currently in a wait-and-see phase, and the upcoming data will likely determine the short-term direction,” Bitfinix analysts told CoinDesk. “If PCE results come in as expected or lean dovish, crypto assets may see a catch-up rally.” Stay alert!

What to Watch

- Crypto

- June 30: CME Group will introduce spot-quoted futures, pending regulatory approval, allowing trading in bitcoin, ether and major U.S. equity indices with contracts holdable for up to five years.

- July 21: Coinbase Derivatives will launch perpetual-style crypto futures in the U.S., starting with bitcoin and ether (ETH). The futures have no quarterly expiration, are available 24/7, track spot prices, and are fully CFTC compliant.

- Macro

- June 27, 9:15 a.m.: Fed Governor Lisa D. Cook will deliver a speech at a Fed Listens event hosted by the Federal Reserve Bank of Cleveland. Livestream link.

- June 27, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases May unemployment rate data.

- Unemployment Rate Est. 6.4% vs. Prev. 6.6%

- June 27, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases May unemployment rate data.

- Unemployment Rate Est. 2.5% vs. Prev. 2.5%

- June 27, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases May consumer income and expenditure data.

- Core PCE Price Index MoM Est. 0.1% vs. Prev. 0.1%

- Core PCE Price Index YoY Est. 2.6% vs. Prev. 2.5%

- PCE Price Index MoM Est. 0.1% vs. Prev. 0.1%

- PCE Price Index YoY Est. 2.3% vs. Prev. 2.1%

- Personal Income MoM Est. 0.3% vs. Prev. 0.8%

- Personal Spending MoM Est. 0.1% vs. Prev. 0.2%

- June 27, 10 a.m.: The University of Michigan releases (final) June U.S. consumer sentiment data.

- Michigan Consumer Sentiment Est. 60.5 vs. Prev. 52.2

- July 1, 9:30 a.m.: Policy panel discussion chaired by Fed Chair Jerome H. Powell at the ECB Forum on Central Banking in Sintra, Portugal. Livestream link.

- Earnings (Estimates based on FactSet data)

- None in the near future.

Token Events

- Governance votes & calls

- Lido DAO is voting on updating its Block Proposer Rewards Policy to SNOP v3. The proposal sets new standards for node operators, including use of vetted APMs and clearer responsibilities to enhance decentralization, fair rewards, and operational security. Voting ends June 30.

- Arbitrum DAO is voting on lowering the constitutional quorum threshold to 4.5% from 5% of votable tokens. This aims to match decreased voter participation and help well-supported proposals pass more easily, without affecting non-constitutional proposals, which remain at a 3% quorum. Voting ends July 4.

- The Polkadot community is voting on launching a non-custodial Polkadot branded payment card to “to bridge the gap between digital assets in the Polkadot ecosystem and everyday spending.” Voting ends July 9.

- Unlocks

- June 30: Optimism OP to unlock 1.79% of its circulating supply worth $16.65 million.

- July 1: Sui SUI to unlock 1.3% of its circulating supply worth $116.59 million.

- July 2: Ethena ENA to unlock 0.67% of its circulating supply worth $10.22 million.

- July 11: Immutable IMX to unlock 1.31% of its circulating supply worth $10 million.

- July 12: Aptos APT to unlock 1.76% of its circulating supply worth $57.11 million.

- July 15: Starknet STRK to unlock 3.79% of its circulating supply worth $13.72 million.

- Token Launches

- June 27: Moonveil (MORE) to be listed on Binance, WEEX, KuCoin, Bitget, BingX, MEXC and others.

- June 27: Blum (BLUM) to be listed on Gate.io, MEXC, WEEX, BingX, CoinW and others.

- June 27: DeFiTuna’s TUNA airdrop checker, allowing users to verify eligibility for next month’s token generation event, went live.

- July 4: Biswap (BSW), Stella (ALPHA), Komodo (KMD), LeverFi (LEVER) and LTO Network (LTO) to be delisted from Binance.

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB10 for 10% off your registration through July 17.

- Day 3 of 3: 7th Blockchain and Internet of Things Conference (Tsukuba, Japan)

- Day 3 of 3: 7th International Congress on Blockchain and Applications (Lille, France)

- Day 3 of 4: Solana Solstice 2025 (New York)

- Day 2 of 2: Istanbul Blockchain Week

- Day 2 of 2: Seoul Meta Week 2025

- June 28: Cyprus Blockchain Summit 2025 (Limmasol)

- June 28-29: The Bitcoin Rodeo (Calgary, Canada)

- June 30: RWA Cannes Summit 2025 (Cannes, France)

- June 30 to July 3: Ethereum Community Conference (Cannes, France)

- June 30 to July 5: World Venture Forum 2025 (Kitzbühel, Austria)

- July 1–6: Bitcoin Alaska (Juneau, Alaska)

- July 4-5: The Bitcoin Paradigm 2025 (Neuchâtel, Switzerland)

- July 4–6: ETHGlobal Cannes (Cannes, France)

Token Talk

By Shaurya Malwa

- SAHARA plunged roughly 40% from a peak of 14 cents on its first day of live trading, dropping to a low near 8 cents, CoinGecko data show.

- Trading volume exploded to $720M–$850M, a surge of as much as 2,700% over the prior day, indicating frenzied activity surrounding the listing.

- SAHARA launched with 20% of total supply (2 billion tokens) in circulation, backed by a Binance “HODLer airdrop” and large institutional funding, including Polychain, Pantera and YZI Labs (formerly Binance Labs).

- With listings across major platforms including Binance and OKX, SAHARA was even part of a Binance airdrop campaign via its Simple Earn program.

- The project aims to build a “decentralized AI economy,” touting 1.4 million testnet users and ecosystem tools spanning data services, model marketplaces and compute networks .

- The price briefly hit highs near $0.59 on secondary futures markets before crashing, indicative of how early stage AI‑crypto tokens can explode — and collapse — within hours.

Derivatives Positioning

- The annualized three-month basis in BTC futures on offshore giants Binance, Deribit and OKX, has jumped above 5%, snapping the downtrend from late May’s highs above 8% in a sign of renewed bias for longs.

- ETH basis continues to trend lower and is holding below 5%.

- On the CME, SOL futures have slipped below an annualized 10% basis, but remain elevated relative to BTC and ETH. SOL volume has cooled sharply to $72 million from $244 million on June 23.

- In altcoins, XLM, BCH and APT stand out as coins with deeply negative perpetual funding rates, suggesting potential for a sharp short squeeze higher.

- On Deribit, BTC risk reversals have shifted positively in favour of calls across all tenors. For ether, front-end options continue to show a bias for puts, with bullishness evident only after the September expiry.

- Overnight BTC options flow on the OTC network Paradigm have been mixed alongside a rollover of put options in ETH.

Market Movements

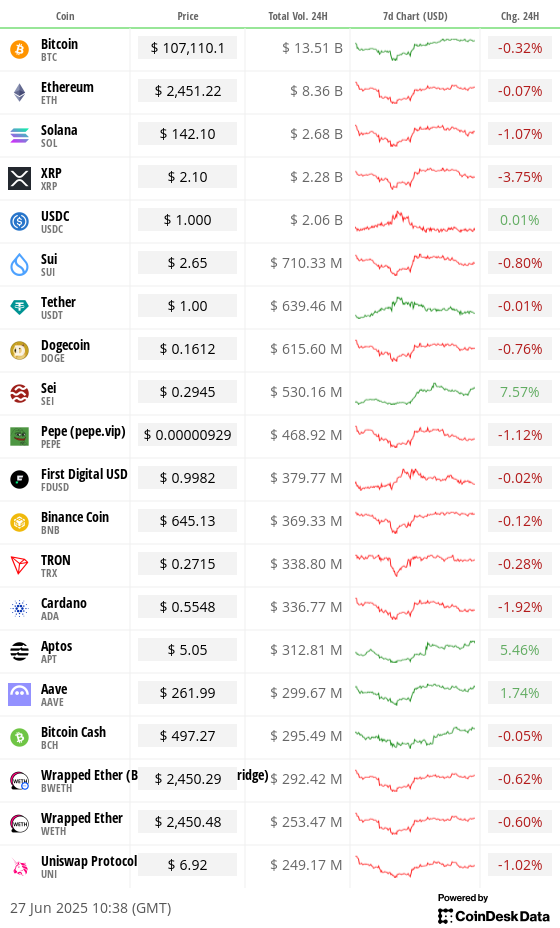

- BTC is down 0.63% from 4 p.m. ET Thursday at $107,154.23 (24hrs: -0.3%)

- ETH is up 0.63% at $2,462.30 (24hrs: +0.03%)

- CoinDesk 20 is down 0.41% at 2,968.88 (24hrs: -0.94%)

- Ether CESR Composite Staking Rate is down 4 bps at 3%

- BTC funding rate is at 0.0038% (4.1840% annualized) on Binance

- DXY is up 0.12% at 97.26

- Gold futures are down 1.55% at $3,296.10

- Silver futures are down 2.26% at $36.09

- Nikkei 225 closed up 1.43% at 40,150.79

- Hang Seng closed down 0.17% at 24,284.15

- FTSE is up 0.56% at 8,784.71

- Euro Stoxx 50 is up 0.98% at 5,295.34

- DJIA closed on Thursday up 0.94% at 43,386.84

- S&P 500 closed up 0.80% at 6,141.02

- Nasdaq Composite closed up 0.97% at 20,167.91

- S&P/TSX Composite closed up 0.70% at 26,751.95

- S&P 40 Latin America closed up +1.76% at 2,657.77

- U.S. 10-Year Treasury rate is up 2 bps at 4.273%

- E-mini S&P 500 futures are up 0.23% at 6,209.00

- E-mini Nasdaq-100 futures are up 0.31% at 22,738.50

- E-mini Dow Jones Industrial Average Index are up 0.22% at 43,814.00

Bitcoin Stats

- BTC Dominance: 65.78% (-0.18%)

- Ether to bitcoin ratio: 0.0229 (1.33%)

- Hashrate (seven-day moving average): 827 EH/s

- Hashprice (spot): $53.81

- Total Fees: 7.57 BTC / $815,336

- CME Futures Open Interest: 156,305 BTC

- BTC priced in gold: 32.3 oz

- BTC vs gold market cap: 9.2%

Technical Analysis

- The bullish case for the bitcoin cash-bitcoin (BCH/BTC) ratio has strengthened with the 14-week relative strength index, a momentum oscillator, topping the 50 mark to suggest upward momentum.

- The RSI is now at its most bullish reading since April 2024.

Crypto Equities

Effective June 30, the price for Galaxy will be for its Nasdaq listing denominated in U.S. dollars rather than the Canadian-dollar-denominated listing on the TSX.

- Strategy (MSTR): closed on Thursday at $386.44 (-0.57%), -0.12% at $385.97

- Coinbase Global (COIN): closed at $375.07 (+5.54%), -0.45% at $373.40

- Circle (CRCL): closed at $213.63 (+7.56%), +4.18% at $222.55

- Galaxy Digital Holdings (GLXY): closed at C$27.94 (+5%)

- MARA Holdings (MARA): closed at $15.27 (+1.94%), -0.52% at $15.19

- Riot Platforms (RIOT): closed at $10.51 (+5.1%), unchanged in pre-market

- Core Scientific (CORZ): closed at $16.36 (+33.01%), +6.36% at $17.40

- CleanSpark (CLSK): closed at $10.81 (+1.98%), -0.37% at $10.77

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $21.5 (+10.37%), +2.79% at $22.10

- Semler Scientific (SMLR): closed at $38.79 (-5.48%), unchanged in pre-market

- Exodus Movement (EXOD): closed at $29.82 (-4.3%), +0.27% at $29.90

ETF Flows

Spot BTC ETFs

- Daily net flows: $226.7 million

- Cumulative net flows: $48.35 billion

- Total BTC holdings ~1.24 million

Spot ETH ETFs

- Daily net flows: -$26.4 million

- Cumulative net flows: $4.12 billion

- Total ETH holdings ~4.08 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The altcoin dominance index, representing the digital market share of all cryptocurrencies, excluding the top 10 tokens, has dropped to the lowest since January 2024, extending a multiyear slide.

- The decline shows that the latest crypto bull market is primarily concentrated in major tokens.

While You Were Sleeping

- Iran’s Foreign Minister Says Nuclear Facilities ‘Seriously Damaged’ (The New York Times): Iran’s foreign minister, Abbas Araghchi, backed a bill to end IAEA cooperation and signaled a shift away from inspections, a move analysts say may be used as leverage in future negotiations.

- Bitcoin’s Double Top Warrants Caution, but a Full-Blown Price Crash Seems Unlikely: Sygnum Bank (CoinDesk): Only a shock event like Terra or FTX would be likely to trigger a major downturn, with current conditions instead favoring a sustained bull cycle, said Sygnum’s head of investment research.

- Market Cap of Euro Stablecoins Surges to Nearly $500M as EUR/USD Rivals Bitcoin’s H1 Gains (CoinDesk): The market cap of euro-pegged stablecoins rose 44% to $480 million, driven by a 138% jump in Circle’s EURC. Still, the combined market cap remains less than 1% of dollar-pegged stablecoins.

- XRP’s Price Volatility Crashes to Lowest Level Since Trump’s Victory. What Next? (CoinDesk): XRP’s price has stayed in a tight band despite the debut of XRP futures and positive regulatory developments, with volatility hovering just above levels that often precede sharp moves.

- A Remote Himalayan Kingdom Bet Big on Bitcoin Mining. So Far, It Has Paid Off. (The Wall Street Journal): Bhutan began mining bitcoin in 2020 using its surplus hydropower and now holds a $1.3 billion stash, equal to 40% of GDP.

- Brazil Supreme Court Rules Digital Platforms Are Liable for Users’ Posts (Financial Times): The 8-3 ruling allows civil liability for platforms that fail to remove illegal content — even without court orders — drawing criticism social platform Meta over censorship and the increase in business risk.

In the Ether