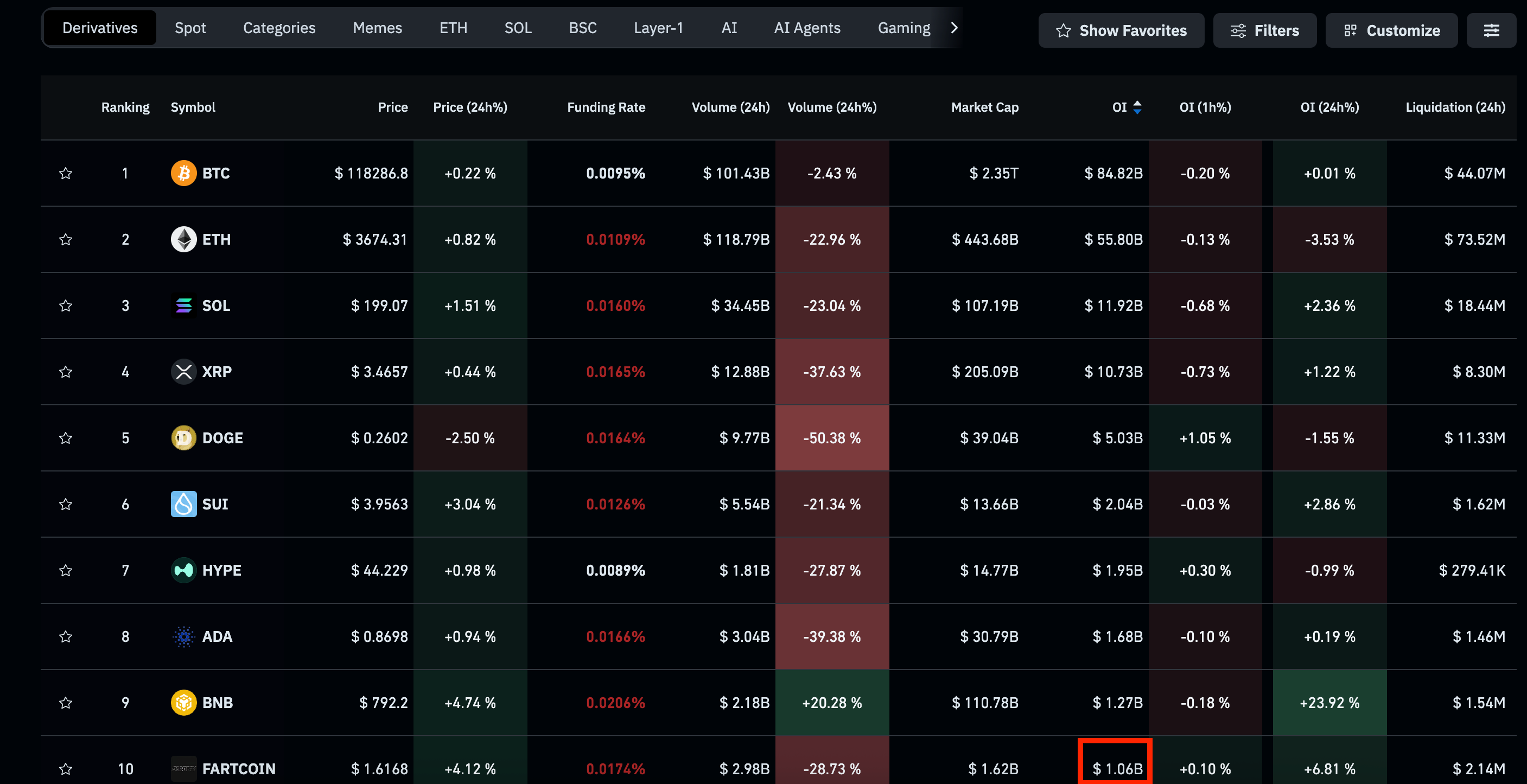

Need evidence of speculator fervor. Look no further than Coinglass’ crypto derivatives leaderboard, which shows that fartcoin (FARTCOIN), the Solana-based memecoin, is now the 10th largest token based on derivatives open interest.

As of writing, notional open interest in futures tied to fartcoin totaled over $1 billion, placing the joke cryptocurrency ahead of well-established coins, such as Litecoin (LTC), Chainlink’s LINK (LINK), Avalanche’s AVAX (AVAX), and several others.

The other tokens play pivotal roles in decentralized finance (DeFi), blockchain oracles and payments. Notional open interest refers to the dollar value locked in the number of open or active derivative contracts at a given time.

What’s more alarming is that fartcoin’s open interest now equals 65% of its market capitalization of $1.62 billion. By market value, fartcoin ranks 83rd in the world. Meanwhile, the $84.7 billion open interest in bitcoin derivatives amounts to just 3.5% of the leading cryptocurrency’s market value of $2.36 trillion.

Fartcoin’s unusually high open interest relative to its market cap indicates a buildup of speculative excesses typically seen during the crypto market bull runs, which drives retail investors to take significant risks in cheaper tokens.

A similar trend is seen in other smaller coins, according to data tracked by Alphractal.

“From the Top 300 down, Open Interest becomes disproportionately high compared to Market Cap — a strong risk signal. What does this mean? These altcoins will eventually liquidate 90% of traders, whether they’re long or short. They are also much harder to analyze with consistency,” founder and CEO of Alphractal, noted on X.