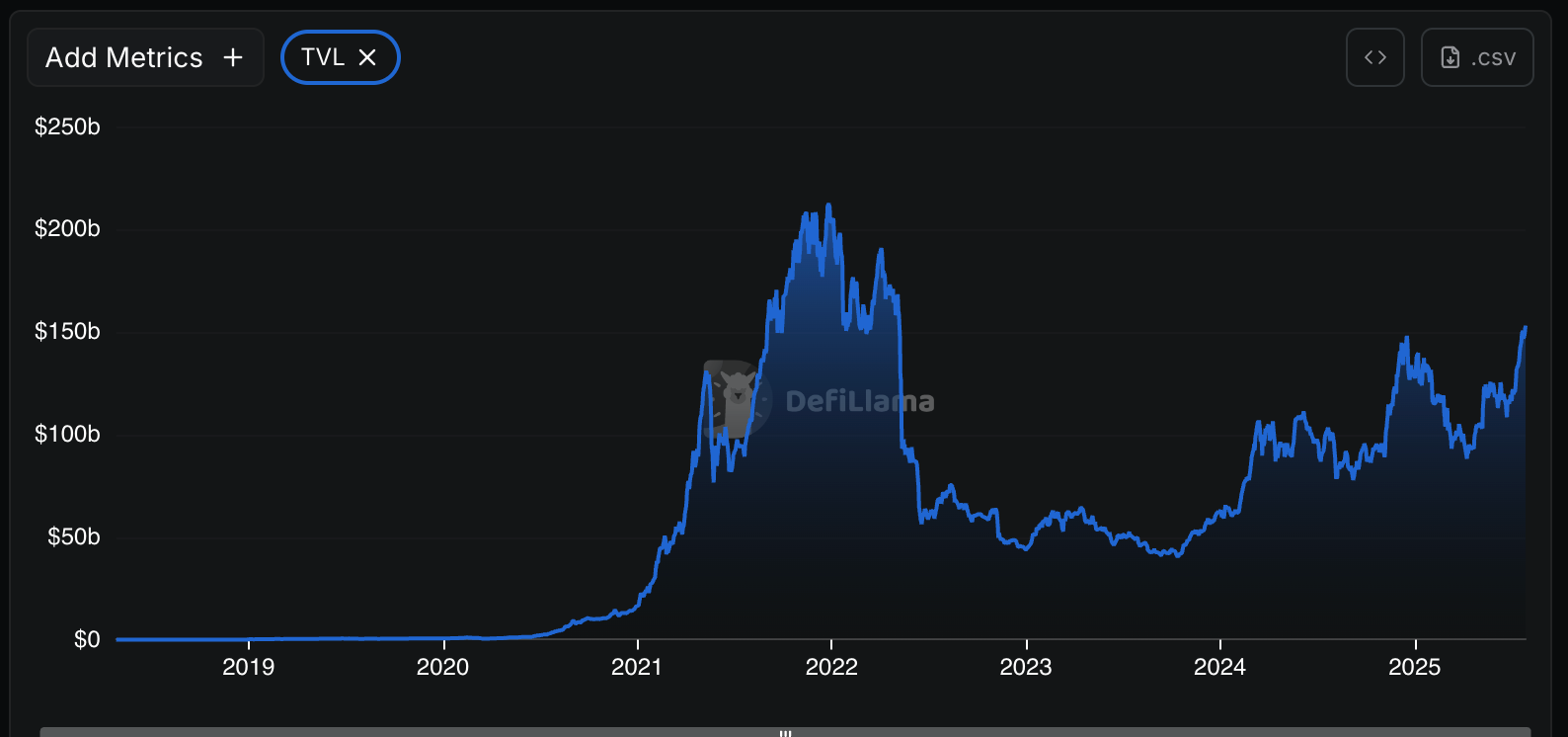

The decentralized finance (DeFi) market ballooned to a three-year high of $153 billion on Monday, spurred by ETH’s ascent toward $4,000 and significant inflows into restaking protocols.

DefiLlama data shows that the uptick in inflows and asset prices over the past week lifted the sector above its December 2024 high to its highest point since May 2022, at the time of $60 billion collapse of Do Kwon’s Terra network.

ETH has risen 60% from $2,423 to $3,887 over the past 30 days following a wave of institutional investment including a $1.3 billion treasury investment from Sharplink Gaming and BitMine’s $2 billion acquisition.

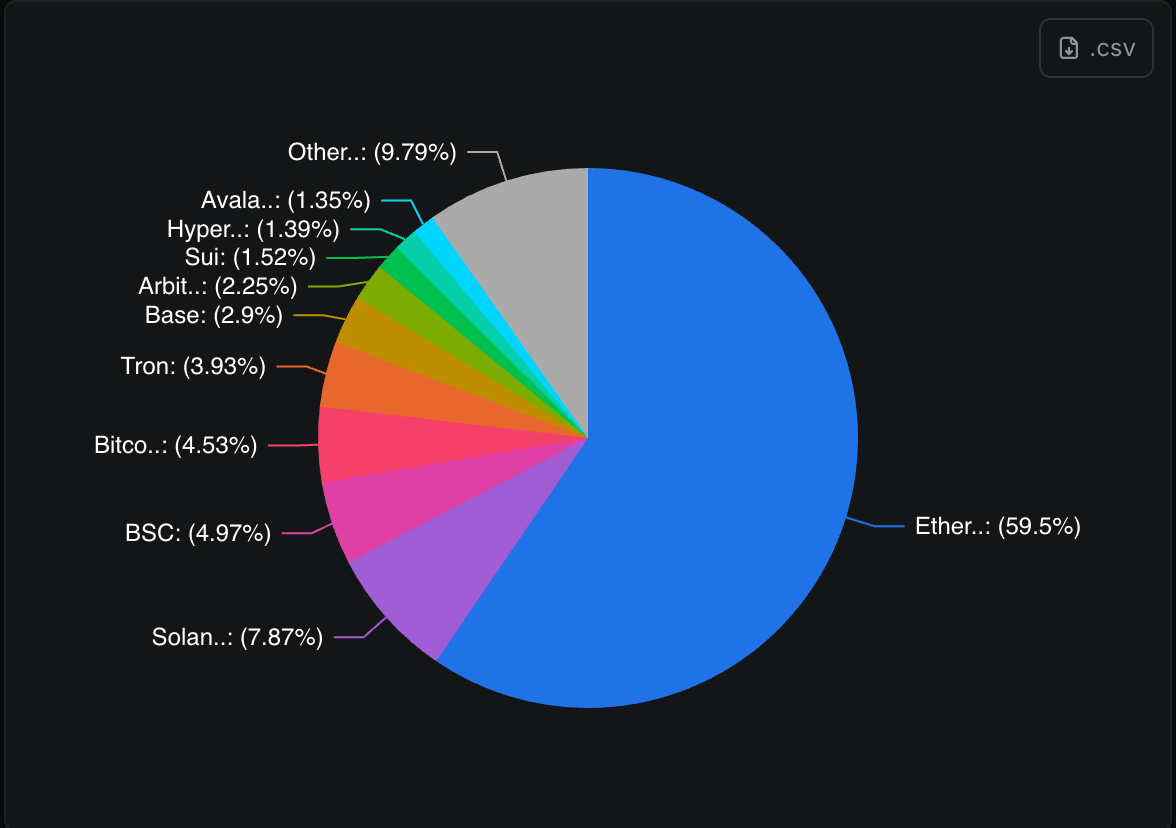

Ethereum still commands the monopoly over DeFi total value locked (TVL) with 59.5% of all capital locked on-chain, the majority of which can be attributed to liquid staking protocol Lido and lending platform Aave, both of which have between $32 billion and $34 billion in TVL.

The yield farming battle

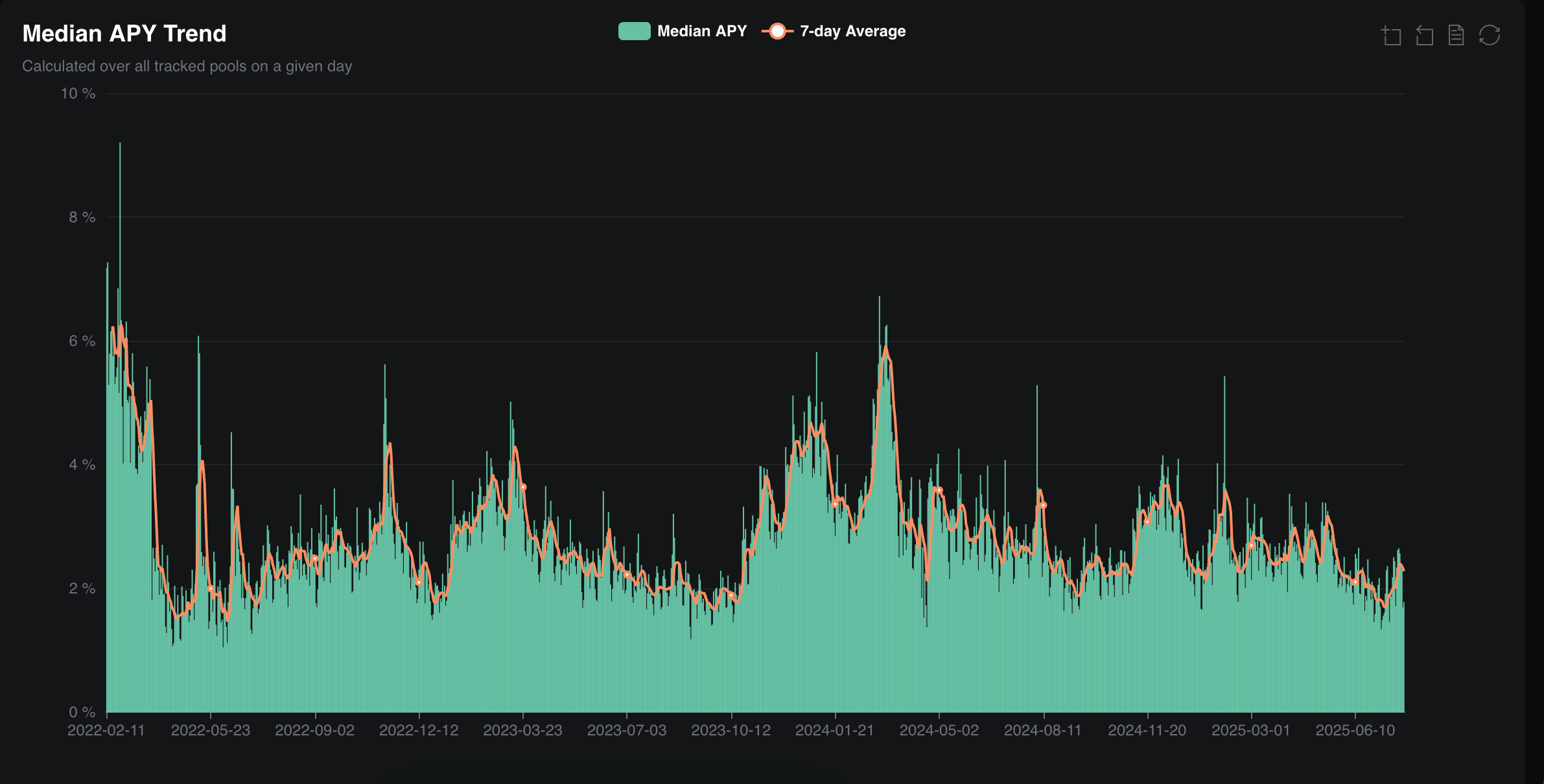

Institutions acquiring assets like ether is one part of the equation, the other is securing a yield on top of that investment.

Investors can stake ETH directly and earn a modest annual yield between 1.5% and 4%, or they can go one step further and use a restaking protocol, which will award native yield and a liquid staking token that can be used elsewhere across the DeFi ecosystem for additional yield.

X user OlimpioCrypto revealed a more complex strategy that can secure an annual return of up to 25% on USDC and sUSDC with low risk and full liquidity. It loops assets between Euler and Spark on Unichain: Users supply USDC on Euler, borrow sUSDC, re-supply it, and repeat. Incentives from Spark (SSR + OP rewards) and Euler (USDC subsidies, rEUL) boost returns.

An easier but less profitable alternative starts by minting sUSDC via Spark and looping with USDC borrow/lend on Euler. Despite UI discrepancies, both methods are reportedly yielding strong returns, likely lasting about a week unless incentives change.

Solana and other blockchains

While much of the attention is understandably on the Ethereum network, Solana’s TVL has grown by 23% in the past month to $12 billion, with protocols like Sanctum, Jupiter and Marinade all outperforming the wider SOL ecosystem with significant inflows, according to DefiLlama.

Investors have also been pouring capital into Avalanche and Sui, which are up 33% and 39%, respectively, in terms of TVL this month. The Bitcoin DeFi ecosystem has been more muted, rising by just 9% to $6.2 billion despite a recent drive to new record highs at $124,000.