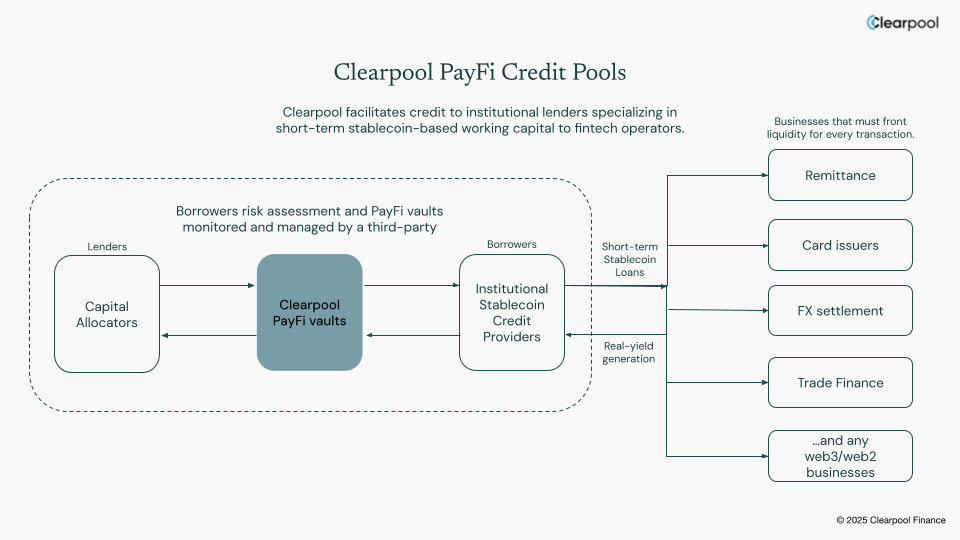

Clearpool, a decentralized credit marketplace, unveiled a suite of products to finance payments, targeting fintech firms processing cross-border transfers and card transactions.

The products include stablecoin credit pools for payment finance (PayFi) and cpUSD, a permissionless token that generates yield from short-term lending to payment providers.

“What many overlook is that while stablecoins settle instantly, fiat does not, forcing fintechs to front liquidity to bridge that gap,” CEO and co-founder Jakob Kronbichler said in a statement on Thursday.

Clearpool’s PayFi pools aim to supply credit to institutional lenders serving these companies, with repayment cycles ranging from one to seven days.

The cpUSD token, backed by PayFi vaults and liquid, yield-bearing stablecoin, aims to deliver returns tied to real-world payment flows rather than speculative crypto activity.

Clearpool’s expansion underscores the broader trend of stablecoins becoming core infrastructure in global payments, particularly in emerging markets where traditional banking rails remain slow or costly. The protocol said it has already originated more than $800 million in stablecoin credit to institutional borrowers, including Jane Street and Banxa.

Read more: PayPal Expands Crypto Payments for U.S. Merchants to Cut Cross-Border Fees