Companies that are buying ether (ETH) for their treasury strategy are a better buy for investors than ETH spot exchange-traded funds (ETFs), said Standard Chartered analyst Geoff Kendrick.

The analyst noted that these firms are attracting attention not just for their holdings but also for their financial structure, which is starting to become attractive for investors.

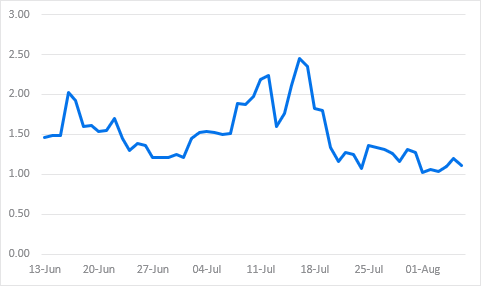

“The NAV multiples (market cap divided by value of ETH held) have now also started to normalise for the ETH treasury companies,” said Kendrick, adding that this dynamic is making the “treasury companies now very investable for investors seeking access to ETH price appreciation.”

Buying ETH for the balance sheet, following Michael Saylor’s bitcoin (BTC) buying strategy, has taken off recently. Many publicly traded firms have jumped on board and seen their share prices surge initially, boosting their market cap and NAV multiples. Now, their NAV multiples are coming down from their initial peak.

Some of the top companies enjoying this market euphoria include BitMine Immersion Technologies (BMNR) and SharpLink Gaming (SBET).

Among these companies, Kendrick highlighted SharpLink Gaming’s (SBET) NAV multiple, which at its peak was around 2.50 and is now coming down to a more normalized level of near 1.0. This means its market cap is only slightly higher than the value of its ETH holdings.

To be sure, the analyst said that he doesn’t see any reason for the NAV to go below 1.0, as these treasury firms provide investors with “regulatory arbitrage opportunities.”

Kendrick also highlighted that these treasury companies have bought just as much ETH as U.S.-listed spot exchange-traded funds (ETFs) since June.

Both groups now hold around 1.6% of the total circulating ETH supply — just under 2,000 ETH — over that time period, adding to his call that both the treasury stocks and ETF holders now provide similar exposure to ETH, all else being equal.

The combination of these two factors is now adding to his thesis that ETH treasury plays are a better buying opportunities than ETFs. “Given NAV multiples are currently just above 1 I see the ETH treasury companies as a better asset to buy than the US spot ETH ETFs,” he said.

Standard Chartered is maintaining its year-end price target of $4,000 for ether. ETH is currently trading at $3,652, up 2% over the past 24 hours.

Read more: Ether Treasury Companies to Eventually Own 10% of Supply: Standard Chartered