Bitcoin (BTC) investors are looking to move past four consecutive Monday losses.

Over the past few weekends, the largest cryptocurrency has experienced significant price volatility, driven by macroeconomic uncertainty including geopolitical tensions, tariffs and rising global bond yields. The weekend nervousness appears to have carried over into Mondays.

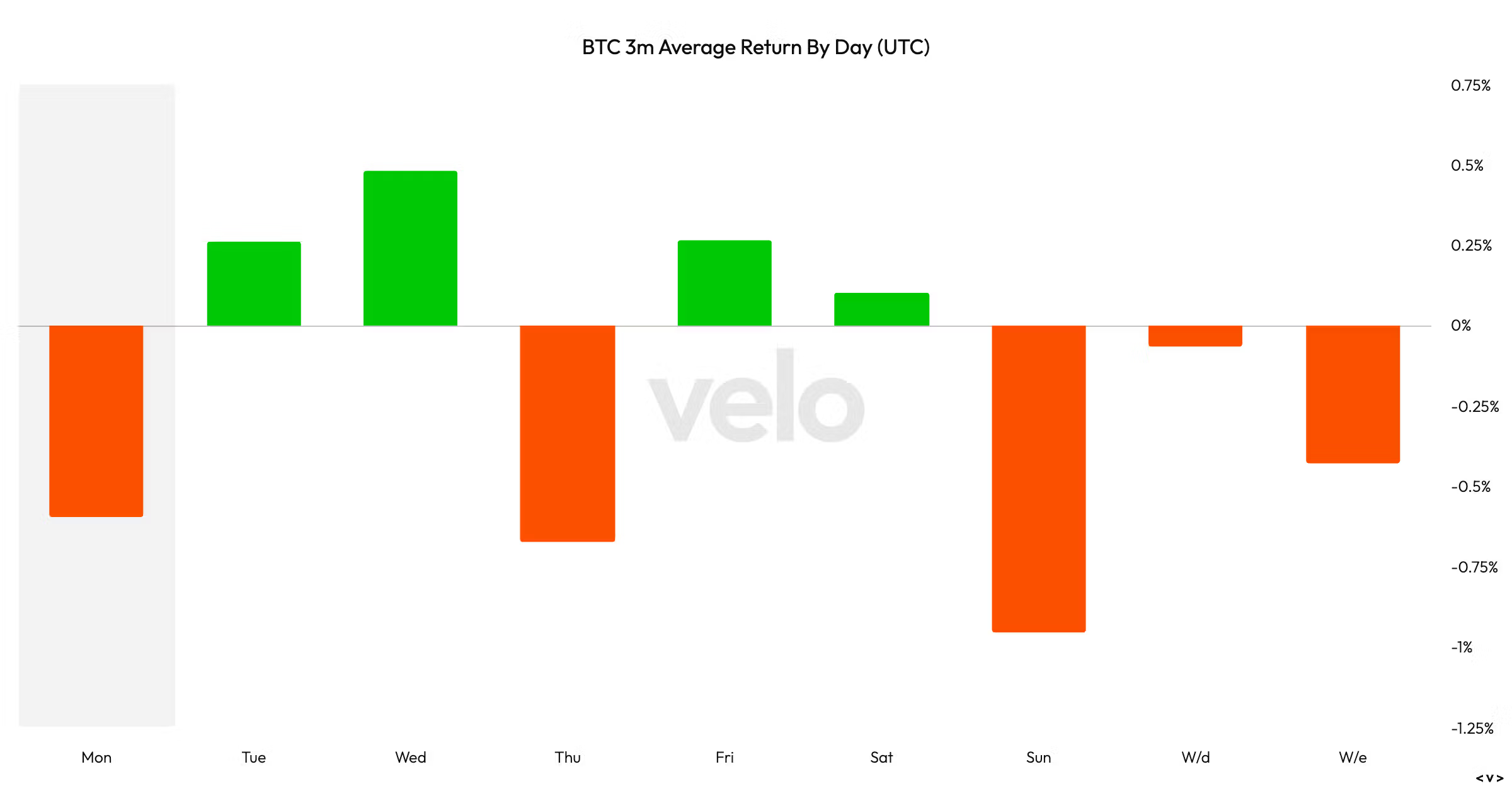

Data from Velo shows the over the past three months Mondays and Thursdays have been the most negative days of the regular workweek. Sunday, however, stands out as the worst-performing day of the week overall, with an average price decline of 1%. Overall, weekends perform slightly worst than weekdays in terms of performance.

Bitcoin has fallen the past four Mondays, Coinglass data shows. It lost 0.31% on Feb. 17, 4.6% on Feb. 24, 8.5% on March 3 and 2.6% on March 10. It has dropped 30% decline from its all-time high in late January, coinciding with a 10% slide in the S&P 500.

The S&P 500 has also experienced three consecutive Mondays of losses. It did not trade on Feb. 17 due to a U.S. holiday.

Bitcoin is trading just 1.4% higher over 24 hours, while S&P 500 futures have turned slightly negative. What happens next is anyone’s guess.