This is a daily technical analysis by CoinDesk analyst and Chartered Market Technician Omkar Godbole.

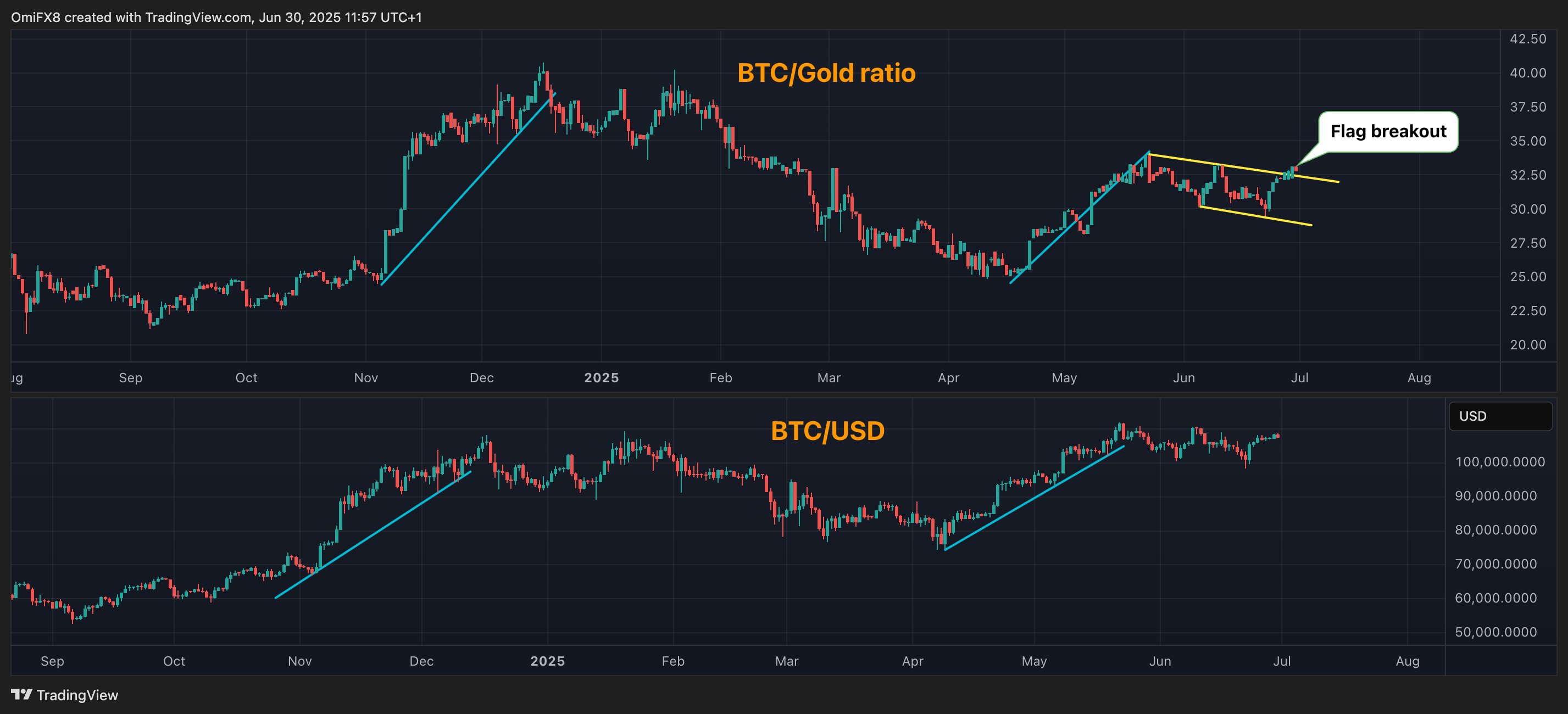

The ratio between the per-piece dollar price of bitcoin (BTC) and gold’s (XAU) per-ounce dollar-denominated price rose over 10% to 33.33 last week, registering its best performance in two months, according to data source TradingView.

The double-digit gain, representing BTC’s outperformance relative to gold, marked a breakout from the bull flag pattern. The so-called flag breakout signals a continuation of the rally from lows near 24.85 reached on April 11.

A bull flag pattern is characterized by a sharp uptrend followed by a relatively brief counter-trend consolidation that usually refreshes higher, as is the case with the BTC-gold ratio.

The flag breakout is said to extend the upside by an amount equivalent to the magnitude of the initial rally. So, the ratio could rise to 42.00, topping the record high of 40.73 hit in December.

Previous uptrends in the ratio have been characterized by sharp upswings in BTC’s dollar-denominated price, as observed in late 2024 and in April and May, rather than gold dropping more than BTC.