Price outlook

Our analysis for 2025 forecasts bitcoin reaching a target of $150,000 in the first half of the year. However, an initial pullback may occur in Q1 if the newly inaugurated Trump administration fails to introduce the anticipated “Strategic Bitcoin Reserve” at the pace expected by the fast-moving crypto market.

Even without a fully implemented reserve strategy, bitcoin is expected to rally, driven by bullish momentum. We anticipate the price to enter the $130,000–$150,000 range by Q2 of 2025, supported by strong market catalysts.

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

Key catalysts driving growth

Regulatory progress: With major regulatory barriers cleared in jurisdictions like the U.S., corporate interest in bitcoin has surged.

Corporate and institutional demand: A growing number of corporations are actively planning to deploy capital into cryptocurrency. Hedge funds, large corporates, and family offices are showing unprecedented enthusiasm for bitcoin exposure.

This widespread interest signifies a strong foundation for bitcoin’s upward trajectory in 2025.

Quantitative models and risks

While optimism runs high, our quantitative models flag no potential risks under $90,000. Specifically:

The Vanguard model, which recently flipped to a buy signal for the first time this year, confirms bullish momentum around bitcoin.

Weekly price closes above $100,000 should keep the bullish sentiment alive.

Insights from DeMark indicator

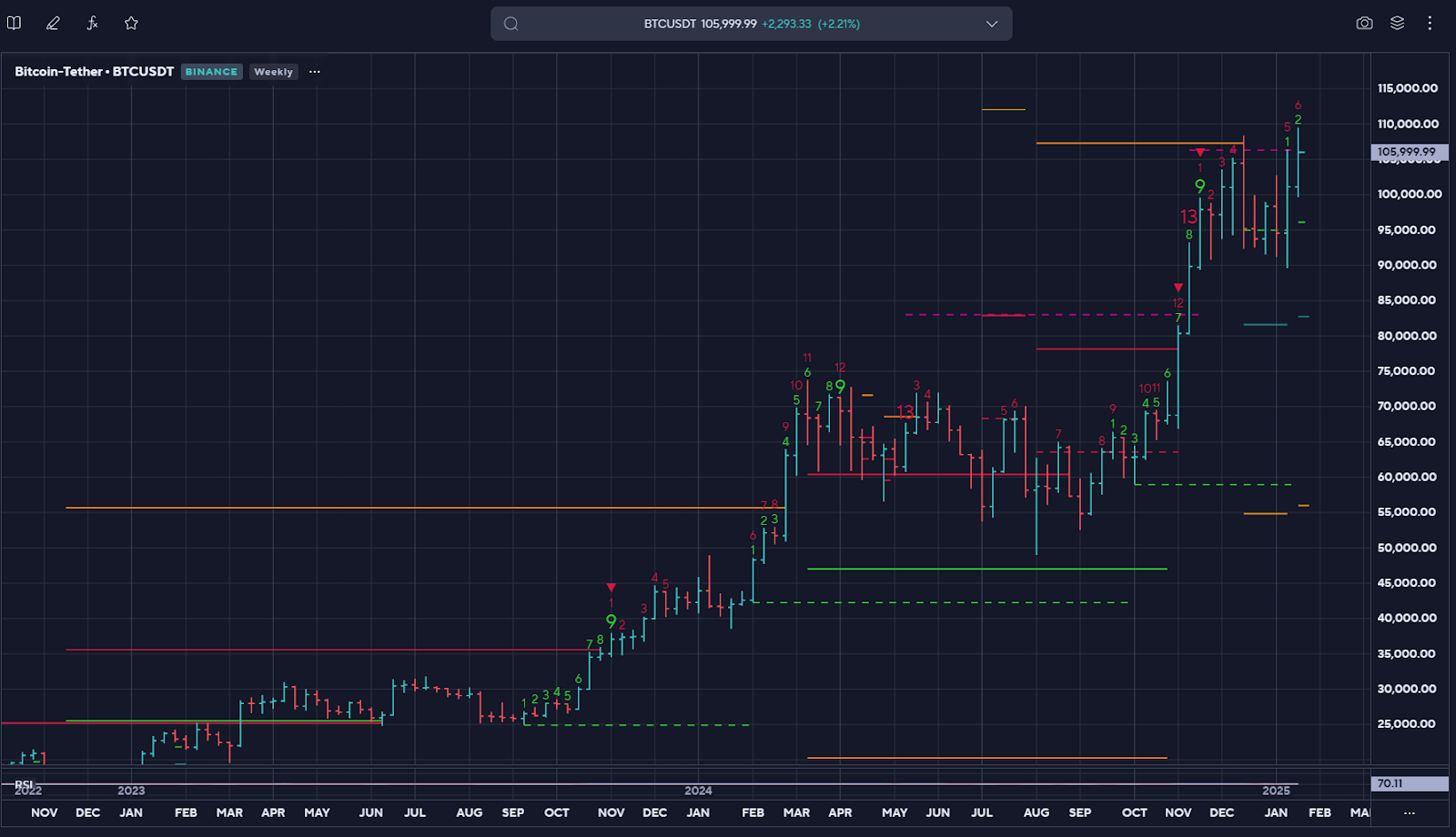

The DeMark TD Sequential indicator suggests bitcoin is on a bullish setup on the weekly timeframe after reaching its propulsion target of $108,300 and completing one of its typical 10% corrections down to $90,000, which was bought with conviction. A propulsion target is a predefined price level derived from a series of calculations that help traders identify key areas of potential support or resistance. These targets are designed to indicate where the price might move in the future, often serving as potential breakout or exhaustion points.

Bitcoin is approximately seven weeks away from completing its bullish TD setup phase eyeing its first potential propulsion target of $119,270.

Weekly price closes above $107,300 could trigger the next bullish acceleration.

The week of Trump’s inauguration, the DeMark TD Sequential indicator showed topping patterns on the daily timeframe introducing a bearish direction towards $90,000, but as long as bitcoin price stays above $104,400, the downside risk is limited.

Dollar strength and macro risks

The U.S. dollar’s weakness in the coming weeks and months presents another catalyst for crypto:

Capital inflows into the U.S. economy

Optimism around Trump’s “America First” policies

DXY technical charts indicative of topping patterns

Summary

Despite potential near-term volatility and choppy price action, we maintain a strong bullish outlook for bitcoin in 2025, with projected highs reaching $150,000 or more. Key risks include corrections toward the $90,000s, should buy signals fail to emerge. We will be navigating this dynamic market for potential long-term value investing at around the $82,000 and $85,000 range. Additionally, weekly price closes below $99,000 should be the trigger for the next bearish leg down.