Bitcoin BTC retreated from Monday’s record high of $123,000 to trade below $117,000, about 5% below the peak, as investors locked in gains earned during the weekend rally in one of the largest profit-realization events for bitcoin this year.

Glassnode data shows that investors collectively realized $3.5 billion in profit over the past 24 hours, with the majority going to long-term holders — defined as those who bought more than 155 days ago, who accounted for 56% of the total.

The largest cryptocurrency’s rapid rally from $108,000 to $123,000 left a notable supply gap because the swift price action meant little trading activity occurred in the $110,000 -$116,000 range.

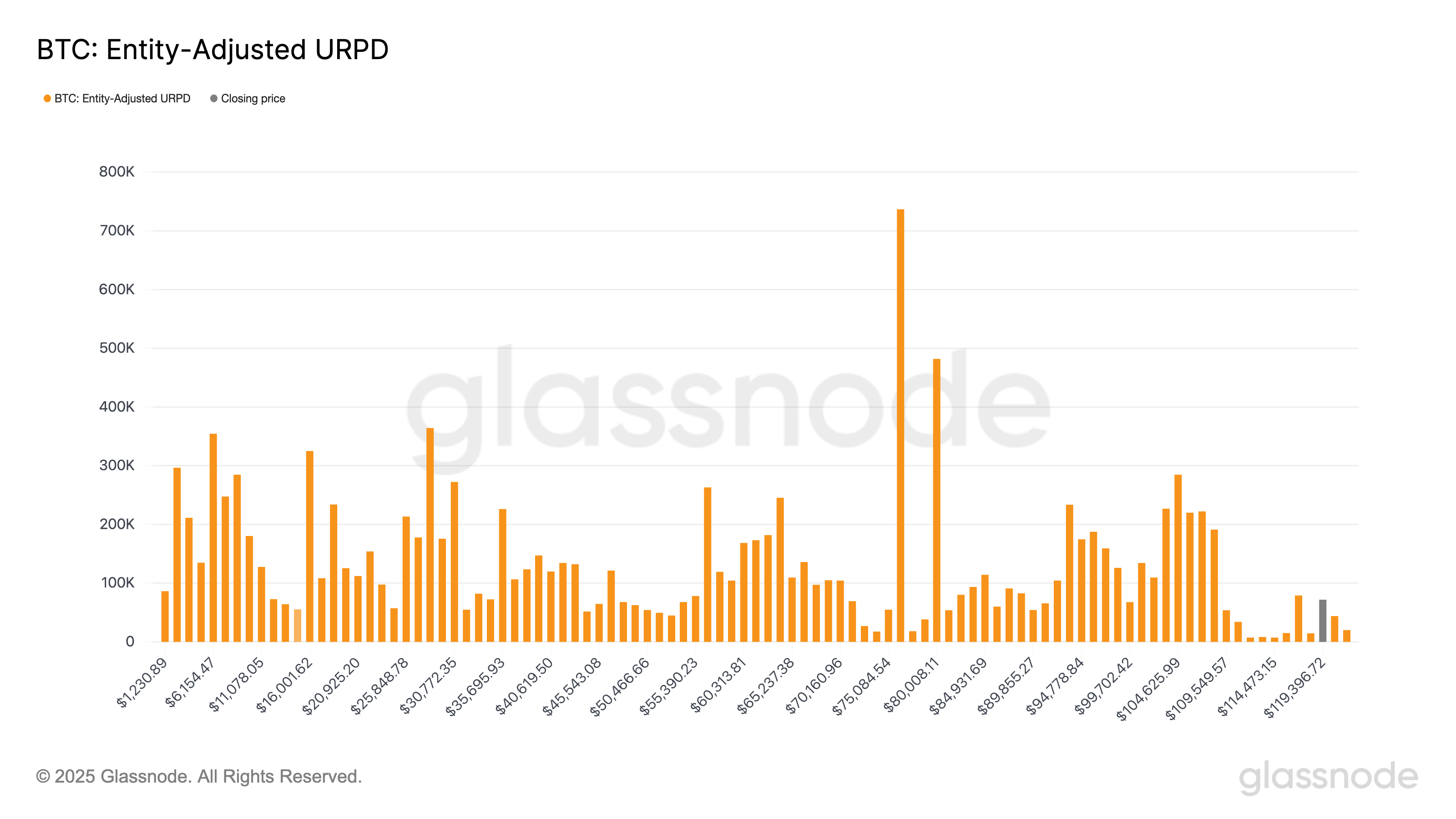

Glassnode’s UTXO Realized Price Distribution (URPD) sheds light on the move. It measures the so-called unspent transaction outputs (UTXO), which capture the prices at which bitcoin was bought and not sold. It represents the prices at which BTC is currently being held across the Bitcoin blockchain.

Each bar in the chart shows the amount of bitcoin that last moved within a specific price range. The entity-adjusted version of this data show above accounts for the average purchase price of each entity’s full balance and excludes internal transfers between addresses owned by the same entity, which do not represent genuine market activity. It also filters out supply held on exchanges, because aggregating millions of users’ funds into a single price point would create distortions in the data.

With minimal supply sitting between $110,000 and $116,000, as shown by the dip at the right-hand side, the market remains vulnerable to sharp moves in either direction.