Bitcoin (BTC) broke out of its recent very tight trading range during U.S. Wednesday afternoon hours, threatening to topple its May record of $112,000.

The largest crypto briefly notched new record prices on some exchanges including Binance, Coinbase and Bitstamp, before retreating towards $111,000.

The move came amid a broader crypto rally that also saw Ethereum’s ether (ETH) surge 6% to $2,760, its highest level in a month. Bitcoin itself was ahead 2.4% at $111,400 at press time.

During today’s swift move higher, some $440 million in leveraged trading positions were liquidated across all crypto derivatives, predominantly shorts anticipating

For BTC, the area around the $110,000 level has been a significant barrier over the past weeks with investors taking profits and shorts piling each time the price neared that level.

Checking crypto-related stocks, Strategy (MSTR) is higher by 4.4% and at $414 only a few dollars shy of its highest level of 2025 (though still well below its record high set late last year of $543). Coinbase (COIN) is ahead 5%. Bitcoin miners MARA Holdings (MARA) and Riot Platforms (RIOT) are up roughly 6%.

Still, market watchers noted that the slow, quiet buildup could be a bullish setup.

“Crypto feels so quiet, [while] bitcoin is ready to move,” wrote Charlie Morris, chief investment officer at ByteTree, in a report.

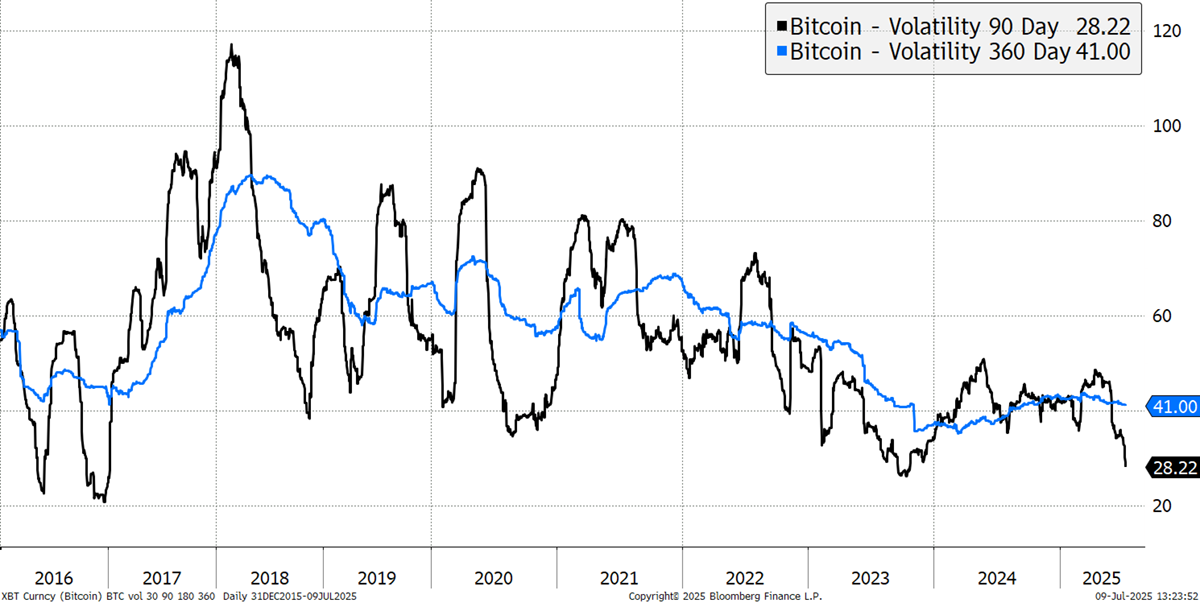

Morris pointed out that bitcoin’s volatility has steadily declined, a pattern that historically preceded large upward moves.

“The setup for the next one is looking good,” he said. “As I keep on saying, the quiet bulls are the best.”

Joel Kruger, market strategist at LMAX Group, pointed to ether’s strength above key technical support levels and growing demand from long-only institutions betting on its future role in settlement infrastructure and asset tokenization.

That view was echoed by digital asset manager Bitwise’s analysts, who named ETH as one of the “cleanest” token plays to bet on the red-hot tokenization trend, The Block reported.

UPDATE (July 9, 20:30 UTC): Adds more details throughout the story.