As the Trump administration appears to fully embrace digital assets in the U.S., there are plenty of reasons to be optimistic about crypto’s future, but also many areas of uncertainty.

In today’s issue, Beth Haddock from Warburton Advisers takes us through the first 30 days of Trump’s term and analyzes the far-reaching impact his administration could have on the crypto industry.

Then, DJ Windle from Windle Wealth answers questions you may have from the article in Ask and Expert.

30 Days of Trump: What’s Changed for Crypto?

A year ago, skepticism and stalled policy progress stunted crypto’s growth. Trump’s election win has shifted the Overton window (referring to the change in political policies that people are willing to accept) on crypto’s acceptance, but will that lead to sustainable growth and regulatory clarity?

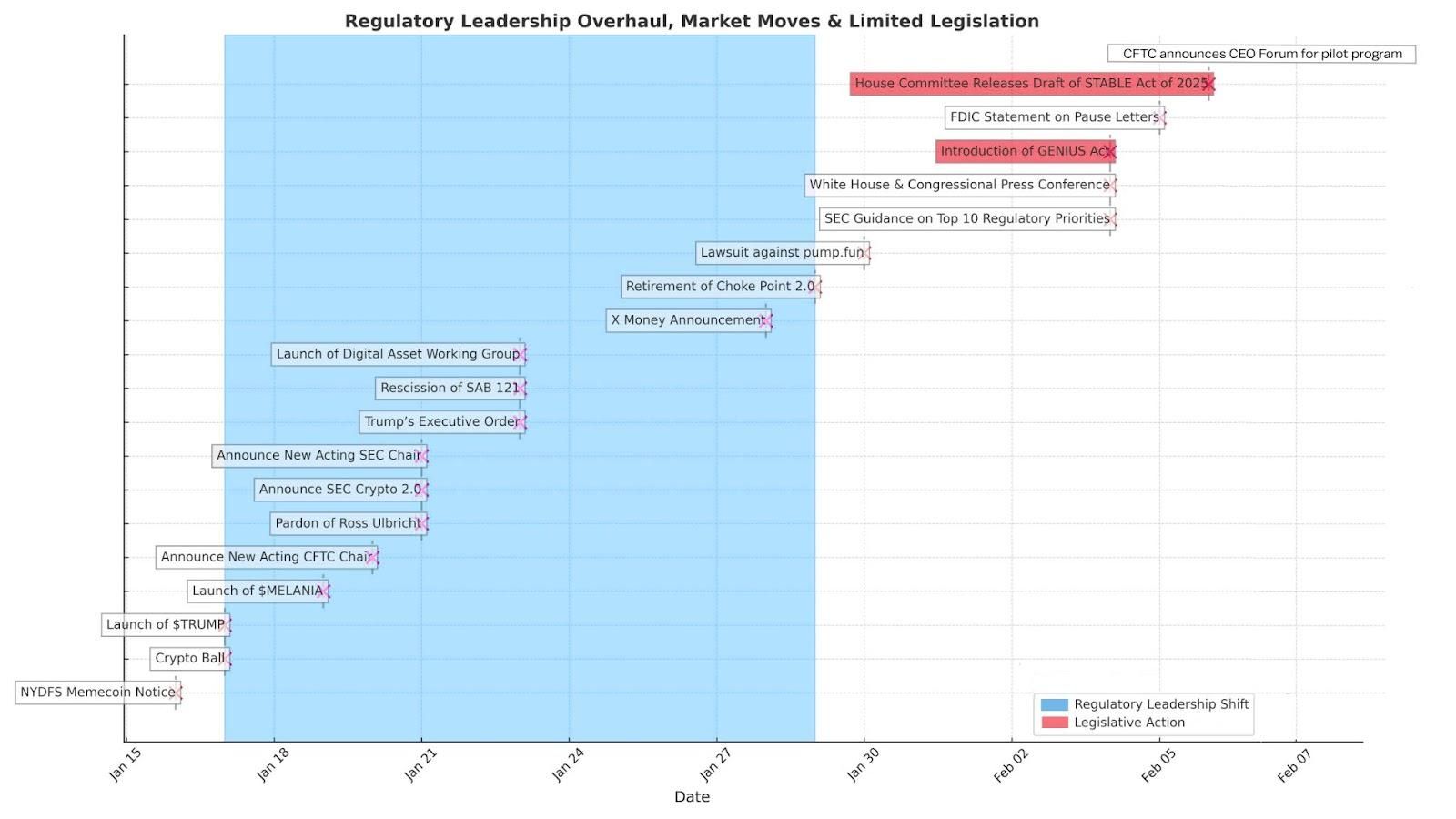

His January 23 Executive Order (EO) addressing crypto prioritizes “responsible growth,” a shift from President Biden’s 2022 EO focused on “responsible development.” Early actions — rescinding SAB 121, ending Operation Chokepoint 2.0, pardoning Ross Ulbricht and appointing new leaders — signal change.

One month in, progress is clear, but obstacles remain. A divided Congress, slow legislation and market speculation — seen in memecoins like $TRUMP and $MELANIA — complicate the path forward. The key question: Are we just moving past FTX, or will crypto be recognized as critical to Web3 innovation?

Three Key Trends to Watch

1. Acceleration of Product Innovation

The chart above clearly illustrates the Trump administration’s early focus on leadership changes and rollbacks of enforcement-driven policies. With regulatory enforcement easing, U.S. crypto development no longer needs to wait — or move offshore.

The SEC’s Crypto 2.0 initiative, led by Commissioner Peirce, shifts from enforcement-first policies to a new Crypto Taskforce. Meanwhile, the President’s Working Group on Digital Asset Markets, chaired by crypto advocate David Sacks, signals a more supportive stance. These shifts create space for innovation, allowing blockchain to prove its value before regulations catch up.

Key areas for progress include stablecoin regulation, clearer digital asset custody requirements, hybrid TradFi-crypto products (such as expected Solana and ETH ETFs) and global payments advancements through partnerships like those with X Money and Visa. Resolving complex policy priorities will take time, as reflected in a16z’s 11 priorities and the Crypto Bar’s open letter, highlighting the breadth of influential voices.

As adoption grows, the network effect of successful crypto products will push for consensus-driven regulation. But without meaningful legislative action, the industry risks a return to uncertainty when Washington’s leadership inevitably shifts again.

2. Speculation vs. Sustainable Growth

Amid all this optimism, crypto still struggles to establish credibility and prove itself as a force for responsible innovation. The opportunity to revolutionize finance is here — but is market speculation part of the growth or is it hindering sustainable growth?

Memecoins like $TRUMP and $MELANIA surged just before the inauguration, reflecting demand for high-risk, culturally driven assets, while also raising regulatory concerns about volatility and integrity. The class action lawsuit against pump.fun underscores skepticism of growth untethered to sustainable utility.

To maintain credibility, crypto must distinguish real-world and potential wealth creation applications from speculative assets. Fraud and misrepresentation remain illegal, whether in memecoins, penny stocks or collectibles. As the market evolves, businesses and investors must prioritize due diligence to separate hype from lasting potential.

3. The Urgent Need for Regulatory Clarity

Despite leadership changes, there remains an urgent need for clear, enforceable crypto regulation. Key unresolved issues include:

Addressing fraud and consumer protections without stifling innovation and decentralized finance

Defining digital asset regulatory authority among agencies

Establishing fit-for-purpose AML frameworks for stablecoins and other innovations

With crypto-friendly leaders now at the SEC and CFTC, regulatory progress is likely, but legislative action will take time. While Congress is considering proposals like the GENIUS Act, the STABLE Act, and new rules for market structure, pragmatic change isn’t guaranteed this year.

For now, the industry must keep shifting the Overton window toward recognizing crypto’s role in U.S. tech leadership, public policy and economic security. Until comprehensive laws emerge, regulatory leadership — seen with the CFTC pilot program and recent Federal Reserve speech — must guide a stable path for growth.

The Path Forward

This year is pivotal — not just because toxic policies are fading and leadership has shifted, but because momentum is driving Web3 and blockchain forward.

The goal isn’t just “responsible growth” but sustainable growth anchored in regulatory clarity. If the industry balances innovation with strong protections against fraud and theft, crypto’s resilience and credibility will be strengthened. With tech-neutral regulations, the U.S. won’t just lead in crypto and AI policy — we’ll also be ready for whatever else is next, from quantum computing to future breakthroughs. Sustainable innovation matters because technological progress is inevitable.

–Beth Haddock, managing partner and founder, Warburton Advisers

Ask an Expert

Q: Who is Ross Ulbricht?

A: Ross Ulbricht created Silk Road, an early bitcoin-powered marketplace that demonstrated crypto’s potential for decentralized commerce — both legally and illegally. His life sentence became a rallying cry in the crypto community, with many arguing it was excessive and highlighting broader debates on financial privacy and government control. His recent pardon has reignited discussions on justice reform and crypto’s role in the future of digital trade.

Q: What are the risks of memecoins?

A: Memecoins like $TRUMP and $MELANIA are highly speculative, with prices driven more by social media hype than real utility. While they can generate quick profits, they also carry extreme volatility and risks of manipulation. Many lack long-term viability, so investors should approach them with caution and avoid putting more in them than they can afford to lose.

Q: How could state bitcoin investments impact adoption?

A: If states allocate reserves to bitcoin, it could legitimize crypto as a store of value, encouraging institutional investors and policymakers to take it more seriously. This could accelerate regulatory clarity, enhance calls for clearer tax guidelines and integrate bitcoin into broader financial infrastructure, helping solidify its role in the economy.

–DJ Windle, founder and portfolio manager, Windle Wealth

Keep Reading

Abu Dhabi’s sovereign wealth fund, Mubadala, has invested approximately $437 million into BlackRock’s bitcoin ETF.

Google looks to simplify bitcoin adoption with wallet integration alongside existing authentication protocols.

FTX’s initial $1.2 billion payout is underway, with creditors with claims of less than $50,000 starting to receive payouts.