As traditional gold markets heat up, crypto investors are following suit—flocking to tokenized versions of the precious metal that offer both price exposure and digital flexibility.

Gold-backed cryptocurrencies like Paxos Gold (PAXG) and Tether Gold (XAUT) have risen 24.15% and 23.7% respectively year-to-date to new all-time highs above $3,300, roughly matching the performance of spot gold. Their prices have since receded slightly to $3,265 and $3,244, respectively.

While gold-backed cryptocurrencies surged so far this year, the wider cryptocurrency market has been in a downtrend. Bitcoin (BTC) has lost more than 11% of its value so far this year, while the wider crypto market has fallen by a little over 30%, based on the CoinDesk 20 (CD20) index.

The tokens, which are backed by physical gold and track its price, experienced a surge in value as investors sought refuge from the uncertainty induced by the escalating U.S.-China trade war.

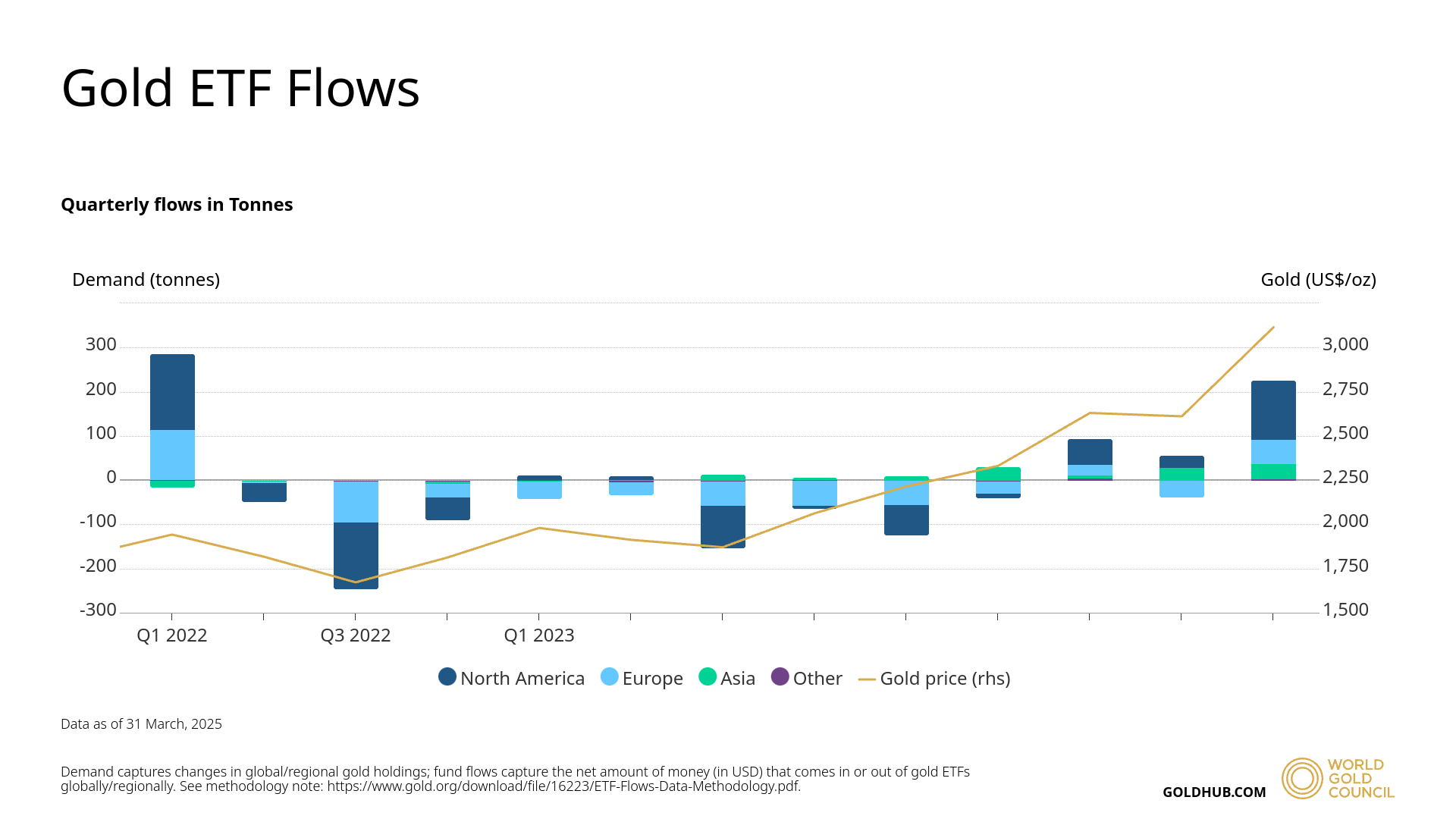

The move echoes a broader return to gold as a safe-haven asset. Inflows into gold ETFs hit 226.5 tonnes in the first quarter of 2025, the highest level since early 2022, according to data from the World Gold Council. Nearly 60% of that demand came from North America.

Similarly, gold-backed cryptocurrencies saw net token minting of over $42.7 million in the first quarter of the year, according to data from RWA.xyz, helping along with gold’s price appreciation raise their total market capitalization near $1.4 billion.