Stablecoin payment volumes are projected to exceed $1 trillion annually by the end of this decade, according to a Thursday joint report from crypto market maker Keyrock and Latin American exchange Bitso.

That growth will be driven by institutional adoption across business-to-business (B2B), peer-to-peer (P2P) and card payment rails, sectors which have already showed signs of rapid uptake, the authors said.

The report underscored why stablecoins are gaining ground in finances: they can outcompete traditional payment methods on both speed and cost. Sending $200 through a bank could carry fees equivalent to up to 13% and take days to settle, while stablecoins can complete the transaction in seconds at a fraction of the price, the report said.

Foreign exchange (FX) settlement could be the largest untapped opportunity, according to the report. The $7.5 trillion-a-day FX market still largely settles on a T+2 basis through correspondent banks. Meanwhile, on-chain FX using stablecoins could enable atomic swaps with near-instant settlement and lower counterparty risks, the report suggested.

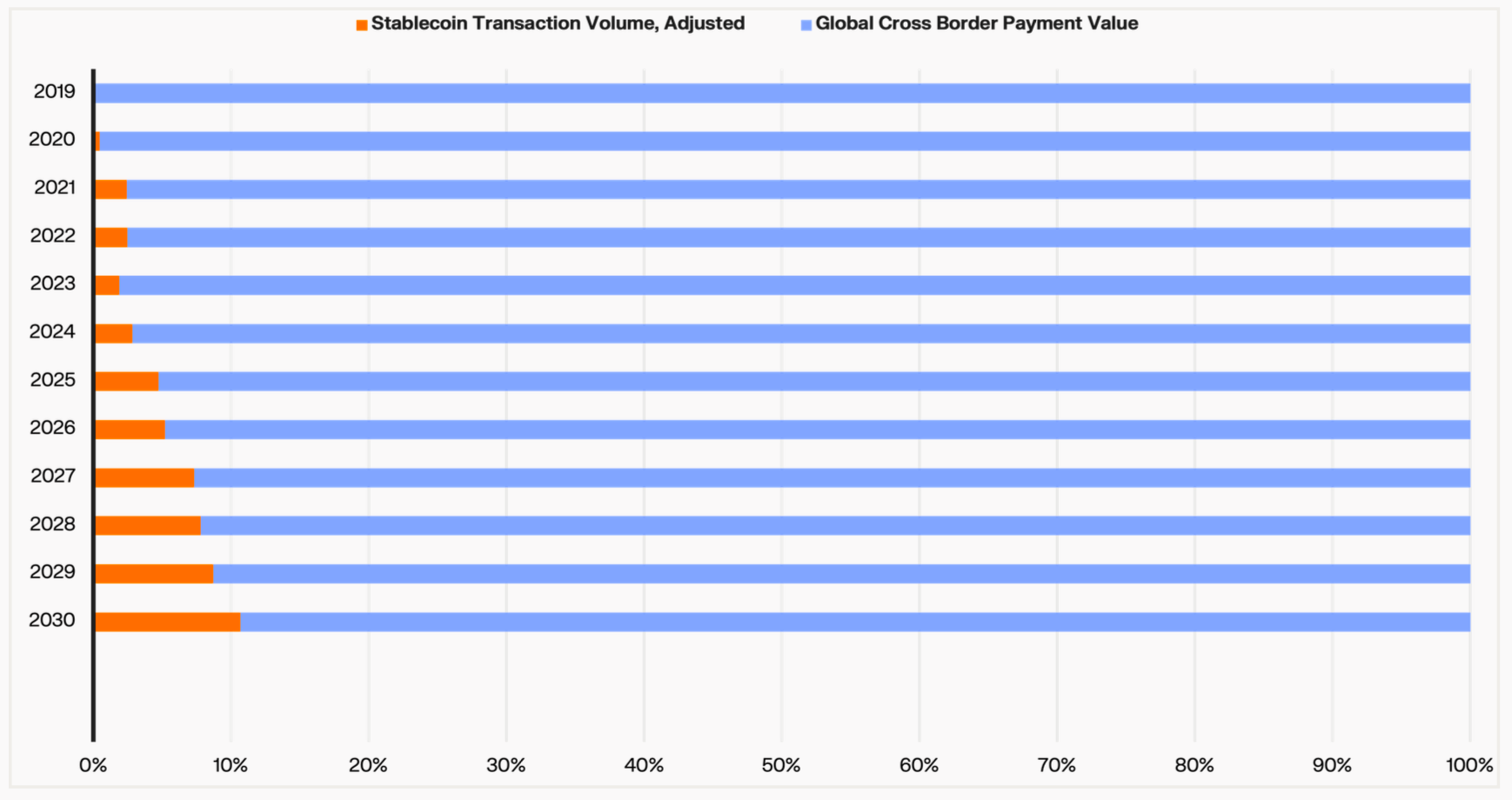

Such efficiencies could also transform cross-border payments. With more regulatory clarity, greater liquidity and interoperability, stablecoins could handle as much as 12% of all cross-border payment flows by the end of the decade.

Given the opportunities, the authors forecasted that every major fintech firms will eventually integrate stablecoin infrastructure over the few next years, just as software-as-a-service (SaaS) tools became ubiquitous.

In practice, that could mean wallets and payment platforms moving value on-chain, treasury desks holding stablecoins and deploying for a yield and merchants settling instantly in multiple currencies.

The rapid growth of stablecoins, which have a market cap of $260 billion, could also have ripple effects on monetary policy. Stablecoin supply could reach 10% of the U.S. M2 money supply in a bull case, up from 1% today, and represent roughly a quarter of the U.S. Treasury bill market and influence how the Federal Reserve manages short-term interest rates.

Read more: JPMorgan Sees Stablecoin Market Hitting $500B by 2028, Far Below Bullish Forecasts