By Omkar Godbole (All times ET unless indicated otherwise)

It’s said that price is the best measure of appeal of any asset. To the dismay of bitcoin (BTC) bulls, the largest cryptocurrency’s price hasn’t gone anywhere in over 50 days, trading directionless above $100,000.

That stagnation has, unusually, eroded the call bias in long-term options. Risk reversals derived from Deribit-listed options expiring in June next year are nearly zero, indicating that calls (bullish) and puts (protective) are trading at similar levels. Historically, long-term risk reversals have tended to be positive, indicating a bias for calls.

“This [risk reversal] could easily go negative as BTC continues to see downside ‘risk-off’ volatility only,” Greg Magadini, director of derivatives at Amberdata, said in an email. “Continued institutional structural flows (sell the call, buy the protective put) can also help push this risk reversal negative long-term.”

Speaking of institutional flows, analysts noted that consistent purchases by Strategy (MSTR) and other companies are failing to offset the general decline in spot demand for BTC. Blockchain analysis has recently indicated that long-term holding wallets are taking profits.

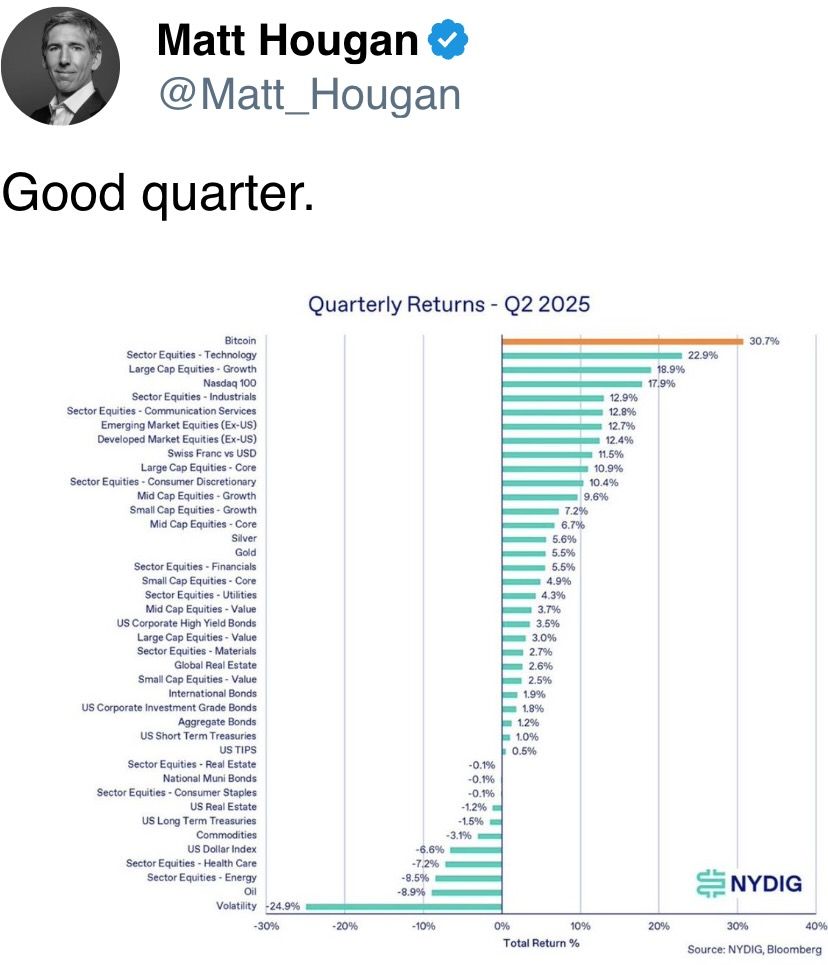

Some traders are focusing on next Tuesday’s U.S. consumer price data after a decline in July Fed rate-cut odds following Friday’s hotter-than-expected jobs report. Meanwhile, pop culture and politics have collided with crypto, as rapper Drake name-dropped bitcoin in his latest track and Elon Musk announced the formation of the America Party, which, he said, would embrace BTC.

“These aren’t just celebrity endorsements, they’re indicators of where the Overton window is shifting,” Mena Theodorou, a co-founder at crypto exchange Coinstash, said in an email. “Crypto’s cultural relevance is clearly growing, and this kind of mainstream attention, whether from artists or entrepreneurs, tends to filter through to investor confidence over time.”

In other news, Ethereum co-founder Vitalik and researcher Toni Wahrstätter proposed EIP-7983 to set a new gas limit for transactions on the blockchain. This is aimed at making it resilient to certain denial-of-service (DoS) attacks, improving stability and offering predictable transaction costs.

Russia introduced a national registry for cryptocurrency mining equipment, effective today to standardize the use of Bitcoin and Ethereum mining equipment and enhance compliance with regulations.

In traditional markets, oil prices dropped early Monday as OPEC increased production, but pared losses later due to a tight physical oil market. Stay alert!

What to Watch

- Crypto

- July 9, 11 a.m.: The Isthmus hardfork activates on Celo (CELO) mainnet, an Ethereum layer-2 network, aligning its L2 stack with Ethereum’s Pectra upgrade and improving scalability, interoperability and security through key Ethereum Improvement Proposals.

- July 14, 10 p.m.: Singapore High Court hearing on WazirX’s Scheme of Arrangement, marking a critical step in the exchange’s restructuring after the $234 million hack on July 18, 2024.

- July 15: Alchemist (ALCH) staking update launches, allowing token holders to stake ALCH for access to advanced features, premium benefits, and ecosystem rewards, potentially boosting token utility and demand.

- July 15: Lynq is expected to launch its real-time, interest-bearing digital asset settlement network for institutions. Built on Avalanche’s layer-1 blockchain and powered by Arca’s tokenized U.S. Treasury fund shares, Lynq enables instant settlement, continuous yield accrual and improved capital efficiency.

- Macro

- July 7: Day 2 of 2 of the 17th BRICS Summit (Rio de Janeiro, Brazil).

- July 7: President Trump meets Israeli Prime Minister Netanyahu at the White House to discuss finalizing a 60-day Gaza ceasefire and staged release of hostages held by Hamas.

- July 8, 8 a.m.: The Brazilian Institute of Geography and Statistics releases May retail sales data.

- Retail Sales MoM Prev. -0.4%

- Retail Sales YoY Prev. 4.8%

- July 9, 12:01 a.m.: End of the 90-day freeze on U.S. reciprocal tariffs announced on April 2. This marks the deadline for trade partners to finalize agreements to avoid higher duties. Treasury plans to notify countries that have yet to secure deals.

- July 9, 8 a.m.: Mexico’s National Institute of Statistics and Geography (INEGI) releases June consumer price inflation data.

- Core Inflation Rate MoM Prev. 0.3%

- Core Inflation Rate YoY Prev. 4.06%

- Inflation Rate MoM Prev. 0.28%

- Inflation Rate YoY Prev. 4.42%

- July 9, 10 a.m.: U.S. Senate Banking Committee holds a hybrid hearing titled “From Wall Street to Web3: Building Tomorrow’s Digital Asset Markets” with CEOs of Blockchain Association, Chainalysis, Paradigm and Ripple testifying. Livestream link.

- July 9, 2 p.m.: Release of Federal Open Market Committee (FOMC) minutes from the June 17–18 meeting.

- Earnings (Estimates based on FactSet data)

- None in the near future.

Token Events

- Governance votes & calls

- Compound DAO is voting on invoking the early termination clause of its 2025 security partnership with OpenZeppelin, giving the required 60-day notice and paving the way for a formal RFP process managed by the Compound Foundation on behalf of the DAO. Voting ends July 7.

- Polkadot Community is voting on launching a non-custodial Polkadot branded payment card to “to bridge the gap between digital assets in the Polkadot ecosystem and everyday spending.” Voting ends July 9.

- Compound DAO is running multiple votes on whether to adopt an Oracle Extractable Value (OEV) solution for Ethereum Mainnet, Unichain, Base, Polygon, Arbitrum, Optimism, Scroll, Mantle, Ronin, and Linea. Delegates can choose between implementing Api3, Chainlink’s Secure Value Relay (SVR), or maintaining the current setup without OEV. Voting for all of these ends July 12.

- Unlocks

- July 11: Immutable (IMX) to unlock 1.31% of its circulating supply worth $10.28 million.

- July 12: Aptos (APT) to unlock 1.76% of its circulating supply worth $50.55 million.

- July 15: Starknet (STRK) to unlock 3.79% of its circulating supply worth $14.51 million.

- July 15: Sei (SEI) to unlock 1% of its circulating supply worth $14.67 million.

- July 16: Arbitrum (ARB) to unlock 1.87% of its circulating supply worth $31.13 million.

- July 18: Official TRUMP (TRUMP) to unlock 45.35% of its circulating supply worth $782.73 million.

- July 18: Fasttoken (FTN) to unlock 4.64% of its circulating supply worth $88.8 million.

- Token Launches

- July 7: OKX to delist trading pairs with Bitcoin SV (BSV), Guild of Guardians (GOG), DIA (DIA), BONE, and Orchid (OXT).

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB10 for 10% off your registration through July 17.

- July 10-13: Mallorca Blockchain Days (Palma, Spain)

- July 16: Invest Web3 Forum (Dubai)

- July 20: Crypto Coin Day 7/20 (Atlanta)

- July 24: Decasonic’s Web3 Investor Day 2025 (Chicago)

- July 25: Blockchain Summit Global (Montevideo, Uruguay)

- July 28-29: TWS Conference 2025 (Singapore)

Token Talk

By Shaurya Malwa

- BonkFun overtook Pumpfun to become the top Solana-based token launchpad, grabbing 55.2% market share.

- The platform has facilitated over $540 million in volume across 175,000 token launches, generating $34 million in fees.

- Pumpfun, which debuted in January 2024, now holds a 34.9% share with $341 million in volume, down from a previous dominant position.

- BonkFun’s fee model drives demand: 58% of fees go toward buying BONK, with 50% of that burned and the rest used for rewards and reserves.

- This structure creates constant buy pressure on BONK, a large-cap memecoin still trading below its peak.

- At current rates, BONK buybacks could reach hundreds of millions annually, tightening token supply.

- Smaller rivals like Believe, Jup Studio and Moonshot trail far behind in volume and user traction.

Derivatives Positioning

- BTC open interest (OI) in perpetuals on offshore exchanges has held largely flat in the past 24 hours. For ETH, however, open interest rose alongside positive funding rates, implying a demand for bullish bets. Kucoin has seen over 20% increase in OI in ETH futures.

- Open interest in XRP perpetuals rose 6% on Sunday, the most in four weeks.

- Funding rates for BNB, TRX, BCH and XLM remain negative, indicating a bearish sentiment for these tokens.

- On Deribit, call bias has drained from longer term BTC risk reversals. ETH’s June 2026 expiry calls still trade at a slight premium of over 1% to calls.

- Block flows on Deribit featured BTC call spreads and longs in September and December higher strike BTC call options

Market Movements

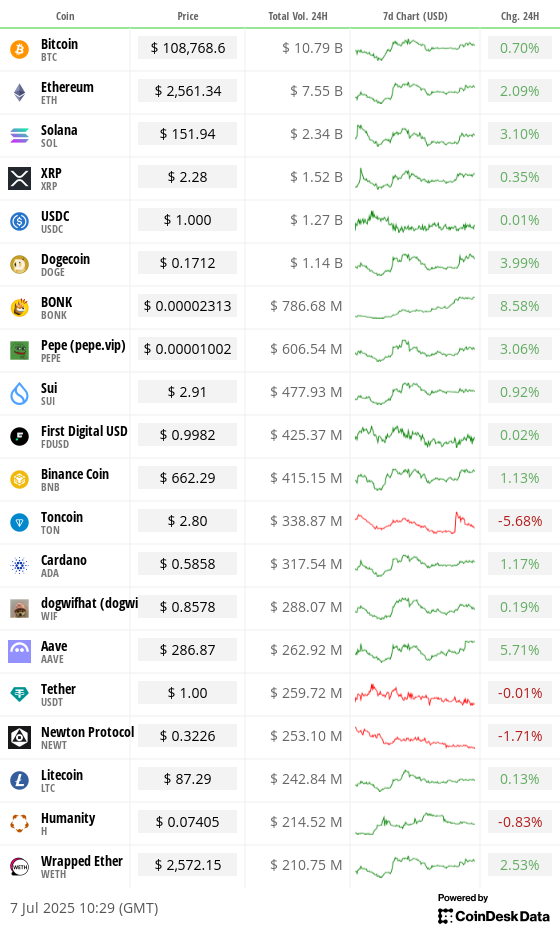

- BTC is up 0.97% from 4 p.m. ET Friday at $108,770.30 (24hrs: +0.71%)

- ETH is up 2.97% at $2,565.19 (24hrs: +2.21%)

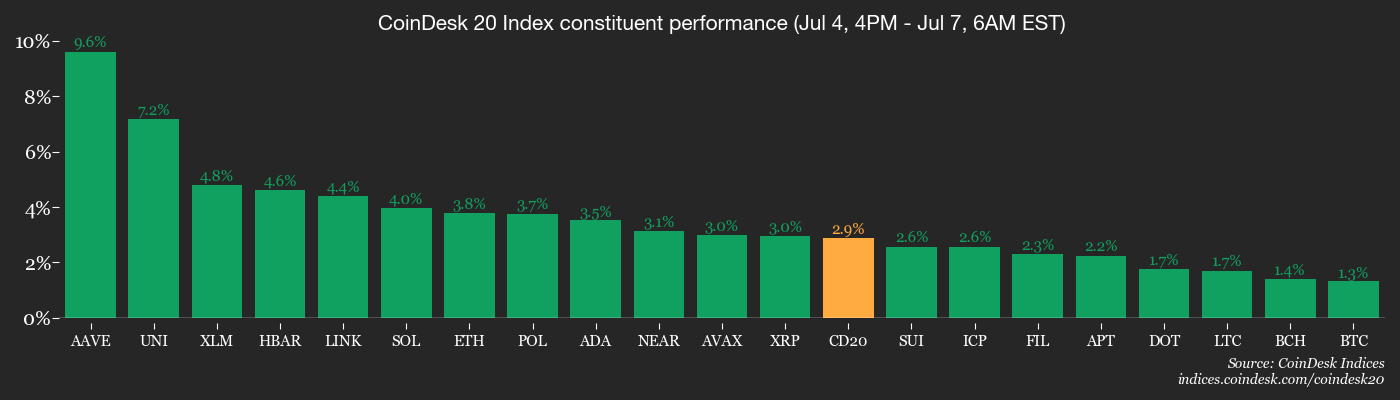

- CoinDesk 20 is up 2.46% at 3,101.28 (24hrs: +1.46%)

- Ether CESR Composite Staking Rate is up 5 bps at 2.93%

- BTC funding rate is at 0.0003% (0.3362% annualized) on Binance

- DXY is up 0.22% at 97.39

- Gold futures are down 0.71% at $3,319.30

- Silver futures are down 0.89% at $36.76

- Nikkei 225 closed down 0.56% at 39,587.68

- Hang Seng closed down 0.12% at 23,887.83

- FTSE is down 0.03% at 8,820.67

- Euro Stoxx 50 is up 0.37% at 5,308.17

- DJIA closed on Thursday up 0.77% at 44,828.53

- S&P 500 closed up 0.83% at 6,279.35

- Nasdaq Composite closed up 1.02% at 20,601.10

- S&P/TSX Composite closed up 0.01% at 27,036.16

- S&P 40 Latin America closed on Friday up 0.49% at 2,741.39

- U.S. 10-Year Treasury rate is up 1.2 bps at 4.352%

- E-mini S&P 500 futures are down 0.38% at 6,300.00

- E-mini Nasdaq-100 futures are down 0.52% at 22,941.75

- E-mini Dow Jones Industrial Average Index are down 0.07% at 45,065.00

Bitcoin Stats

- BTC Dominance: 65.23% (-0.11%)

- Ether to bitcoin ratio: 0.02359 (0.21%)

- Hashrate (seven-day moving average): 880 EH/s

- Hashprice (spot): $58.92

- Total Fees: 4.01 BTC / $435.096

- CME Futures Open Interest: 151,005 BTC

- BTC priced in gold: 32.7 oz

- BTC vs gold market cap: 9.26%

Technical Analysis

- BONK’s price has convincingly topped the 200-day simple moving average (SMA) confirming the bullish trend. Prices failed to establish a foothold above the key average in mid-May, which led to a deeper sell-off.

- The latest breakout has shifted focus to resistance at $0.00002583, the high on May 12.

Crypto Equities

- Strategy (MSTR): closed on Thursday at $403.99 (+0.43%), -0.41% at $402.35 in pre-market

- Coinbase Global (COIN): closed at $355.8 (+0.38%), -0.74% at $353.17

- Circle (CRCL): closed at $188.77 (+6.07%), +1.79% at $192.15

- Galaxy Digital (GLXY): closed at $21.75 (-2.12%), -0.64% at $21.61

- MARA Holdings (MARA): closed at $17.66 (-0.79%), -0.68% at $17.54

- Riot Platforms (RIOT): closed at $12.17 (-0.25%), -0.33% at $12.13

- Core Scientific (CORZ): closed at $18 (+2.51%), -0.89% at $17.84

- CleanSpark (CLSK): closed at $12.25 (-1.84%), -0.57% at $12.18

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $26.03 (+3.5%)

- Semler Scientific (SMLR): closed at $40.45 (+2.3%), -1.71% at $39.76

- Exodus Movement (EXOD): closed at $32.8 (+11.41%, +3.02% at $33.79

ETF Flows

Spot BTC ETFs

- Daily net flows: $601.8 million

- Cumulative net flows: $49.62 billion

- Total BTC holdings ~1.25 million

Spot ETH ETFs

- Daily net flows: $148.5 million

- Cumulative net flows: $4.42 billion

- Total ETH holdings ~4.16 million

- Source: Farside Investors

Overnight Flows

Chart of the Day

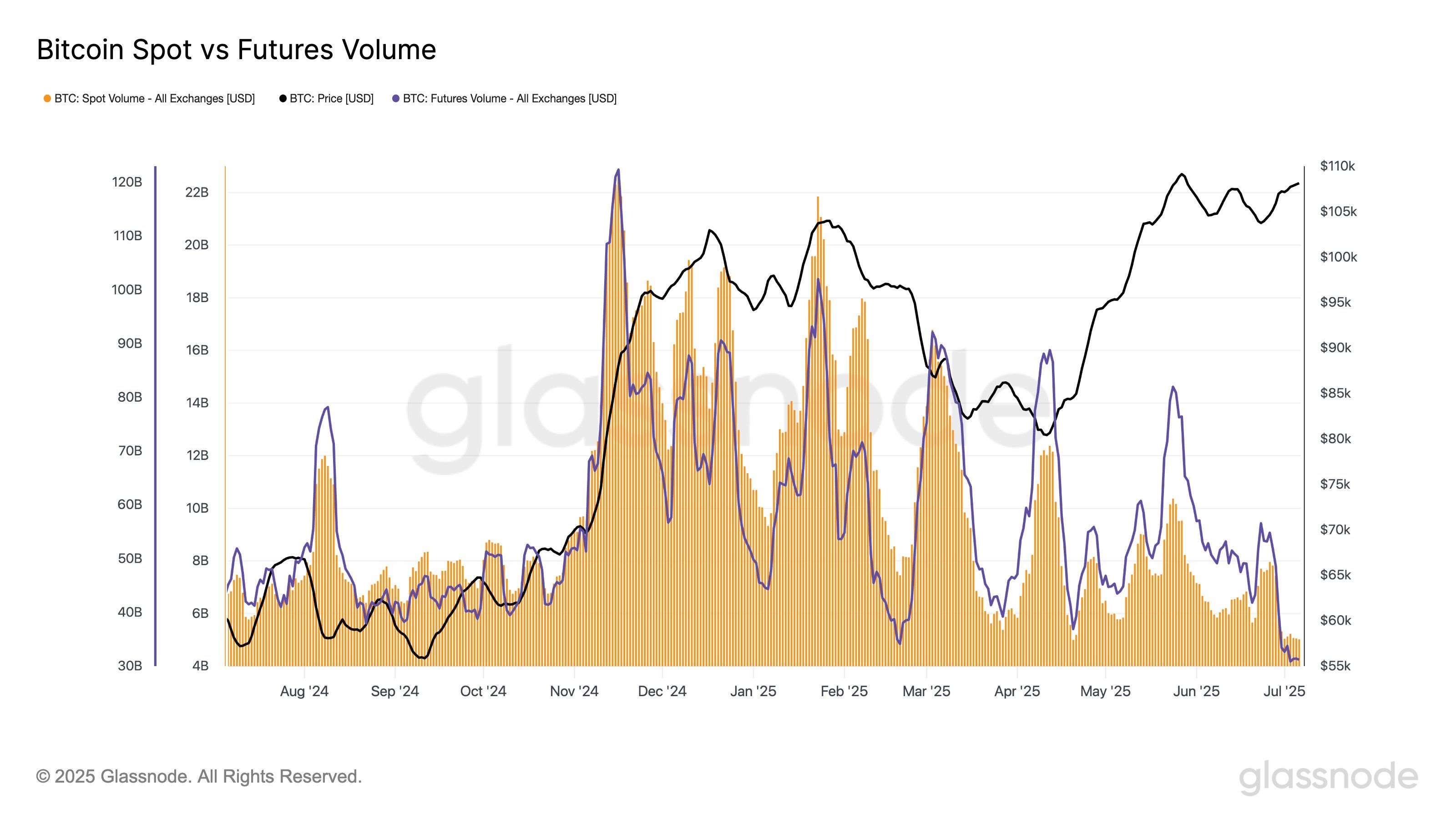

- The chart shows trading volumes in bitcoin’s spot and futures markets have dropped to $5 billion and $31.2 billion, the lowest for both in over a year.

- Activity typically slows during the summer, often leading to weak order book depth, which makes the market price vulnerable to few large orders.

While You Were Sleeping

- Trump Threatens Extra 10% Tariffs on BRICS as Leaders Meet in Brazil (Reuters): On Sunday, Brazilian President Lula called on BRICS to spearhead institutional reforms, citing rising global instability since the G20 and framing the group as a modern successor to nonaligned powers.

- Bitcoin Whales Scoop Up BTC as Price Nears Record High in Sign of Growth Expectations (CoinDesk): Glassnode data suggests that large bitcoin holders are accumulating as the price nears $109,000, while smaller investors continue to sell, signaling a supply shift from retail to potentially institutional wallets.

- Metaplanet Picks Up Additional 2,205 BTC, Holdings Now Cross 15,555 Bitcoin (CoinDesk): Metaplanet’s latest bitcoin purchase totaled 34.49 billion yen ($213 million), raising its total investment to 225.82 billion yen at an average price of 14.52 million yen per bitcoin.

- The Blockchain Group Bolsters Bitcoin Reserves With $12.5M BTC Acquisition (CoinDesk): The firm confirmed acquiring 116 BTC for about 10.7 million euros ($12.51 million), raising its total holdings to 1,904 BTC and achieving a year-to-date BTC yield of roughly 1,348%.

- China and Russia Keep Their Distance From Iran During Crisis (The New York Times): Alexander Gabuev of the Carnegie Russia Eurasia Center said the Iran crisis showed how Russia and China prioritize self-interest over coordination, lacking the alliances or shared values seen among U.S. partners.

- Trump and Netanyahu to Meet as New Middle East Tests Loom (The Wall Street Journal): Trump sees Israel-Hamas talks and Iran’s recent military and diplomatic setbacks as an opening to pursue Saudi-Israel normalization, though progress hinges on Netanyahu’s Gaza war stance and Iran’s nuclear position.

In the Ether