Disclaimer: The analyst who wrote this piece owns shares of Strategy (MSTR).

Strategy (MSTR) expects its convertible preferred stock Strike (STRK) to be listed on Nasdaq on Thursday, according to a slide in its earnings presentation.

Strategy, formerly known as MicroStrategy, also introduced new performance metrics when it reported fourth-quarter earnings after the market closed on Wednesday. The Tysons Corner, Virginia-based company reported a loss of $3.03 per share. It did not adopt Financial Stability Accounting Board (FASB) rules, which would have avoided a $1 billion impairment loss. Those will be adopted this quarter, the company said.

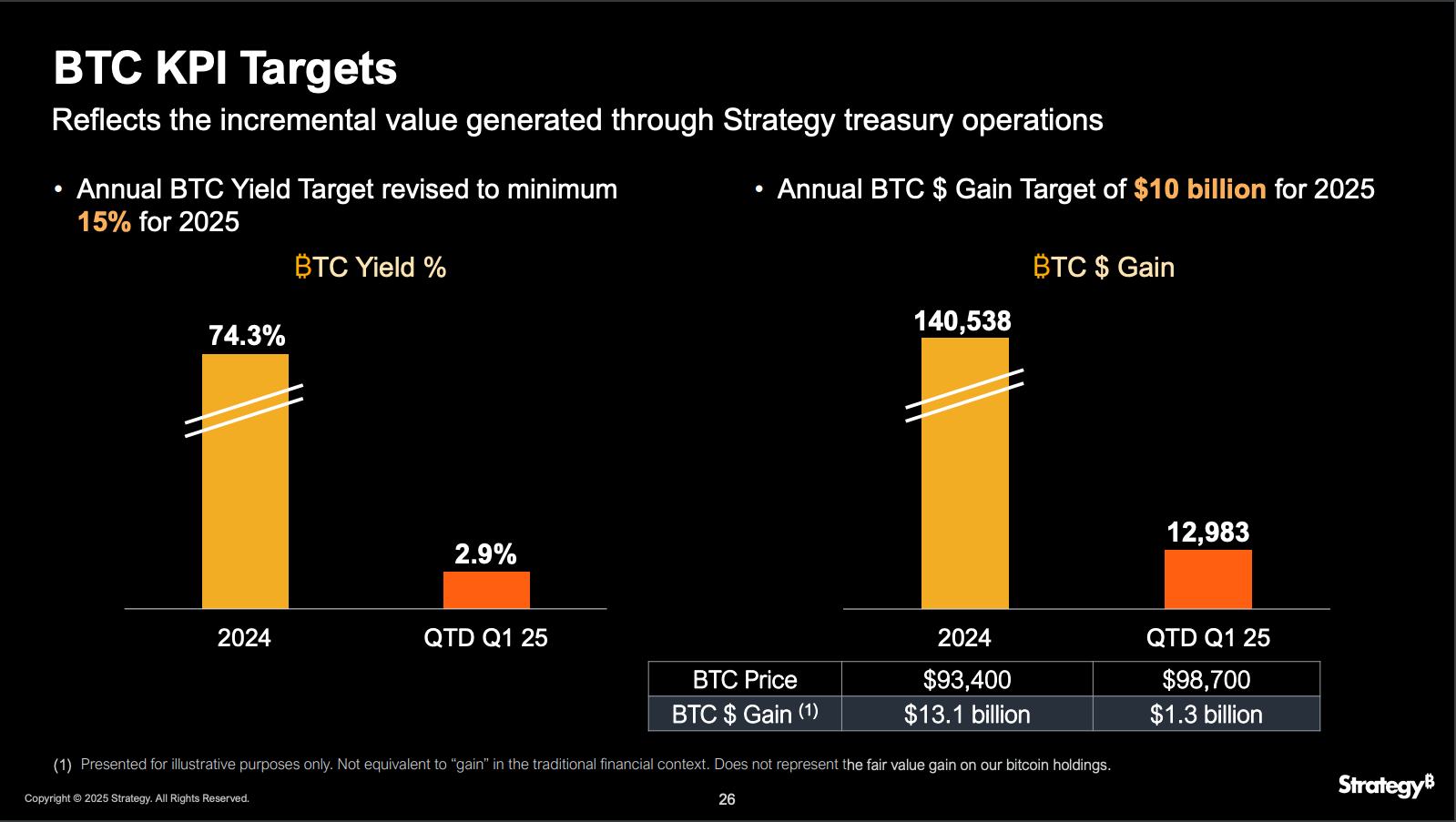

Among the new key performance indicators, is an 2025 bitcoin (BTC) gain of $10 billion. So far this year, it’s achieved $1.24 billion. A second KPI is a bitcoin yield of 15%; year-to-date it’s 2.9%.

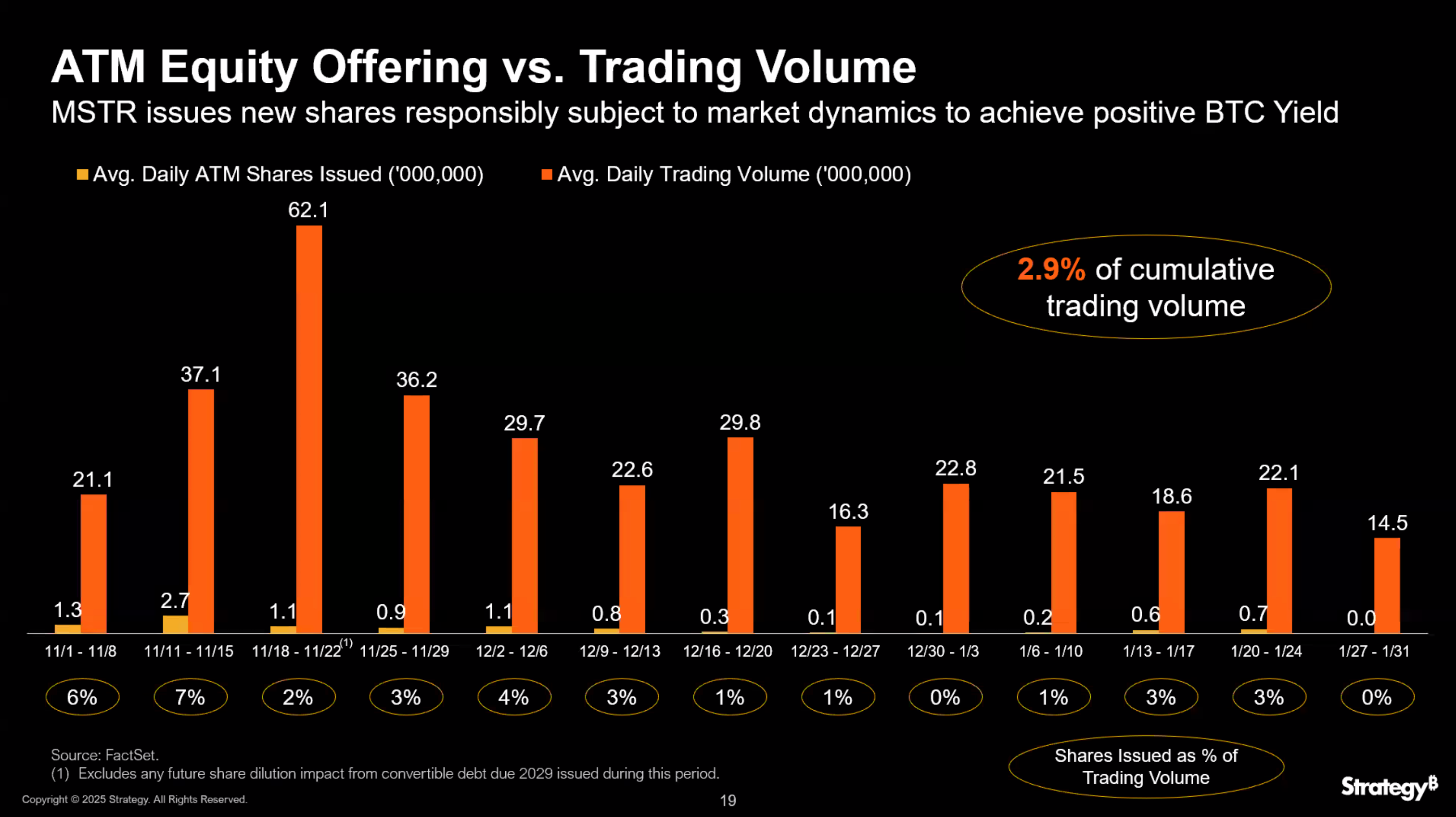

Strategy has used about $17 billion out of the $21 billion at-the-market (ATM) equity program so far. In the earnings presentation, the company alluded to the share sales being just 2.9% of the total cumulative trading volume, with Nov. 11-15 being the highest percentage of total trade volume of any week at 7%.

Shares of the company were recently 1.3% higher in pre-market trading.